Looking for the best stocks to invest in today? Our DCF valuation reveals Travelers (TRV) may be deeply undervalued with over 385% upside potential in the bull case. With strong free cash flow, a stable dividend, and growth visibility, TRV stands out as one of the best growth stocks for the next 5 years. This data driven analysis is ideal for investors focused on long term stocks, shares, and stocks with solid fundamentals.

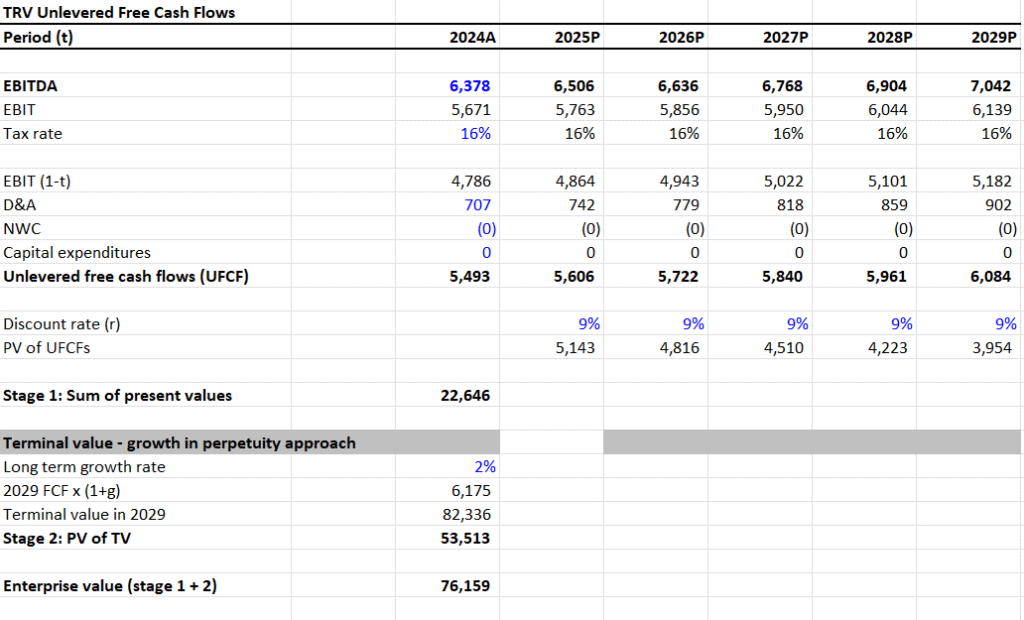

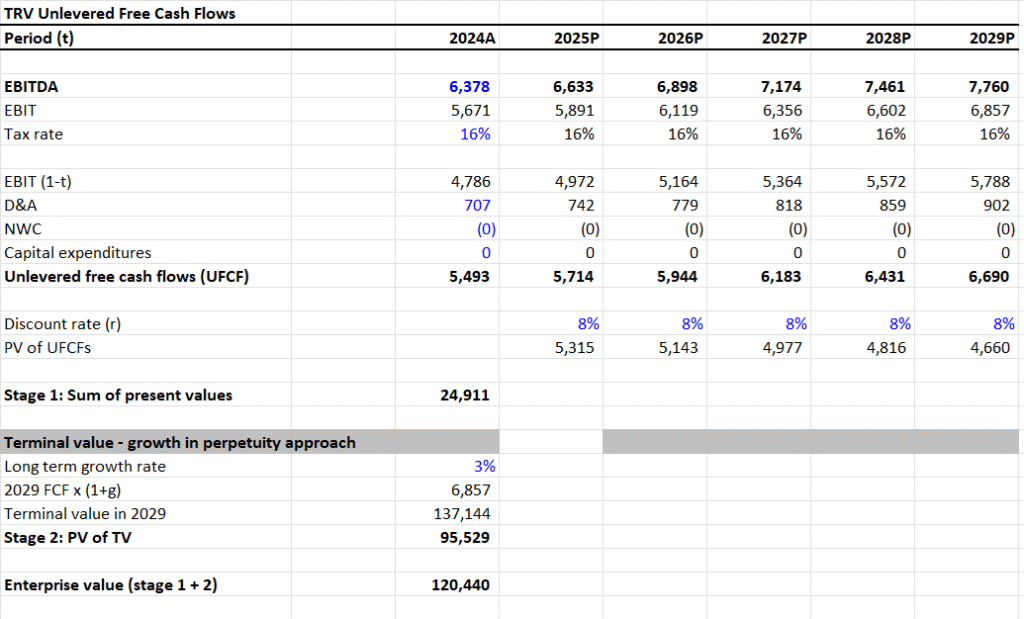

I. DCF Valuation — Bear Case

Assumptions:

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

Valuation Outputs:

- Sum of PV of UFCF (2024–2029): $22,646

- Terminal Value: $82,336

- PV of Terminal Value: $53,513

- Enterprise Value (EV): $76,159

- Net Debt: -$83,264

- Equity Value: $159,423

- Shares Outstanding: 227M

- Intrinsic Value per Share: $691.64

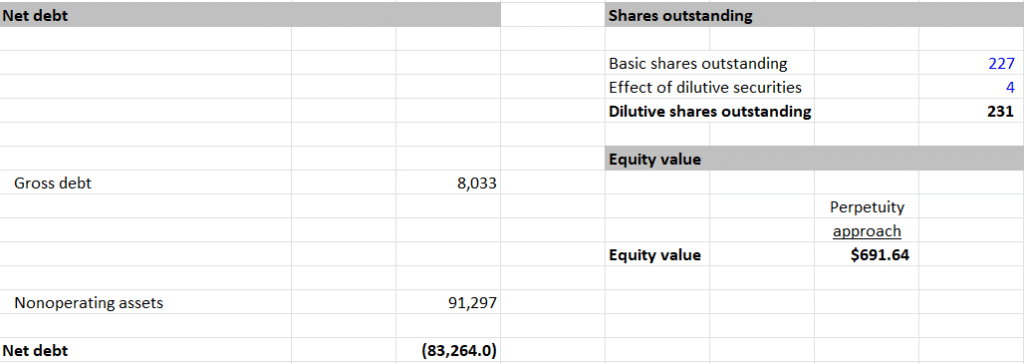

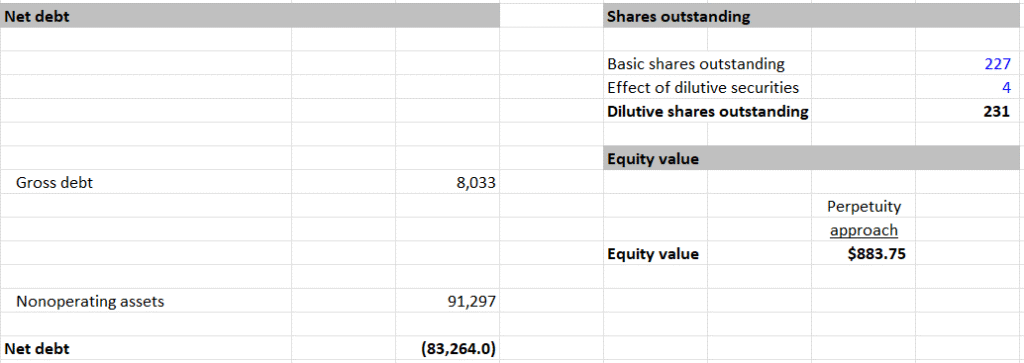

II. DCF Valuation — Base Case

Assumptions:

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

Valuation Outputs:

- Sum of PV of UFCF (2024–2029): $24,911

- Terminal Value: $137,144

- PV of Terminal Value: $95,529

- Enterprise Value (EV): $120,440

- Net Debt: -$83,264

- Equity Value: $203,704

- Shares Outstanding: 227M

- Intrinsic Value per Share: $883.75

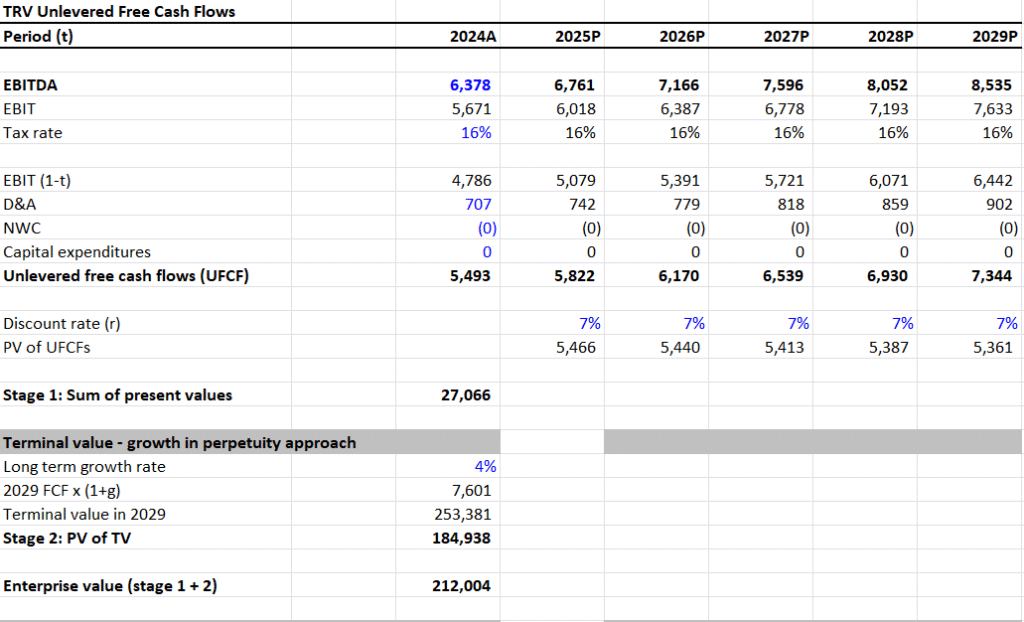

III. DCF Valuation — Bull Case

Assumptions:

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

Valuation Outputs:

- Sum of PV of UFCF (2024–2029): $27,066

- Terminal Value: $253,381

- PV of Terminal Value: $184,938

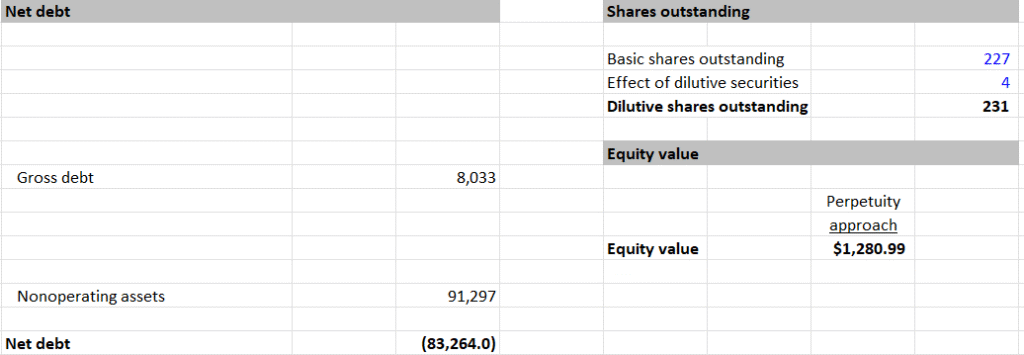

- Enterprise Value (EV): $212,004

- Net Debt: -$83,264

- Equity Value: $295,268

- Shares Outstanding: 227M

- Intrinsic Value per Share: $1,280.99

IV. Valuation Summary and Upside Potential

- Current Price: $264

- Bear Case Intrinsic Value: $691.64 → 162% Upside

- Base Case Intrinsic Value: $883.75 → 234% Upside

- Bull Case Intrinsic Value: $1,280.99 → 385% Upside

V. Dividend Sustainability Analysis

- Dividend per Share: $4.20

- Shares Outstanding: 227M

- Total Dividends Paid: 227 × 4.20 = $953M

- Free Cash Flow (Used for Analysis): $8,976M

Dividend Payout Ratio (FCF Basis):

- $953 / $8,976 = 0.106 or ~10.6%

Assessment:

- Very low payout ratio

- TRV retains ~89% of FCF for reinvestment, debt reduction, or buybacks

- Dividend appears extremely sustainable

VI. Summary View

This report adheres to a quantitative-only, assumption-transparent methodology. With strong free cash flow and a conservative payout policy, TRV appears significantly undervalued in all modeled cases.

- Valuation Range: $691.64 – $1,280.99

- Dividend Risk: Minimal, with ample coverage and reinvestment room

- Quantitative Takeaway: Current price of $264 is far below modeled intrinsic value

D.R. Horton (DHI): An Undervalued Stock With Strong Upside Across Scenarios (2025)