Looking to invest in trading or searching for a good stock to invest in? Valero Energy (NYSE: VLO) stands out as one of the best new stocks to consider, backed by strong free cash flow and dividend resilience. This report breaks down VLO’s intrinsic value under bear, base, and bull case scenarios using data-driven DCF modeling. Whether you’re into public investing or looking for good stocks to invest in for beginners, VLO offers a compelling valuation profile worth a closer look.

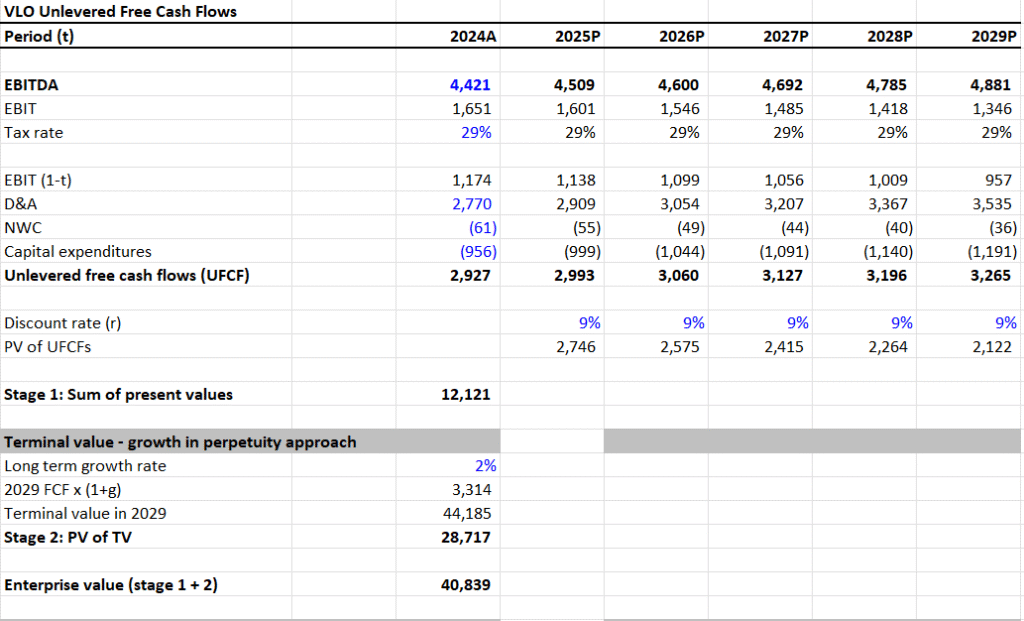

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $12,121

- Terminal Value (TV): $44,185

- PV of Terminal Value: $28,717

- Enterprise Value (EV): $40,839

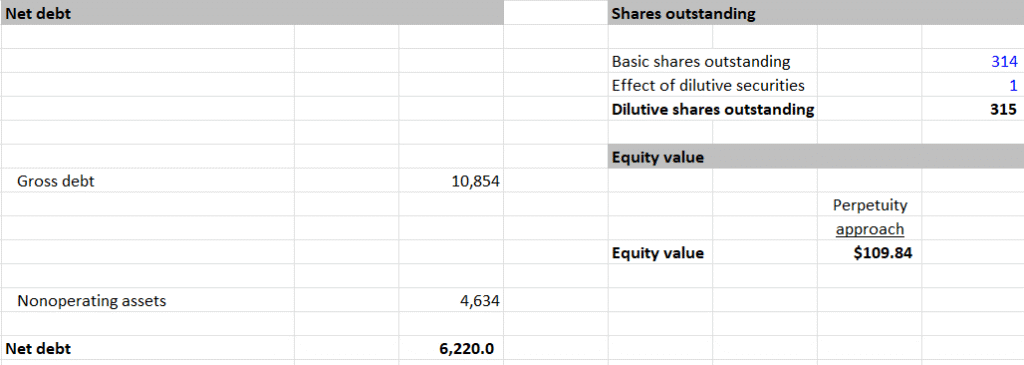

- Net Debt: $6,220

- Equity Value: $34,619

- Shares Outstanding: 314M

- Intrinsic Value per Share: $109.84

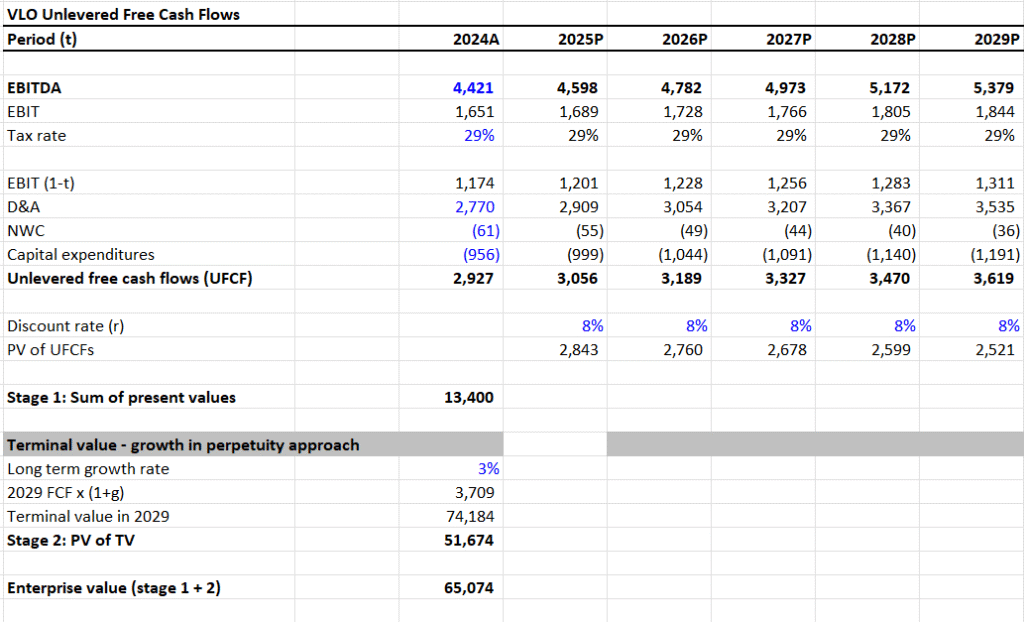

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $13,400

- Terminal Value (TV): $74,184

- PV of Terminal Value: $51,674

- Enterprise Value (EV): $65,074

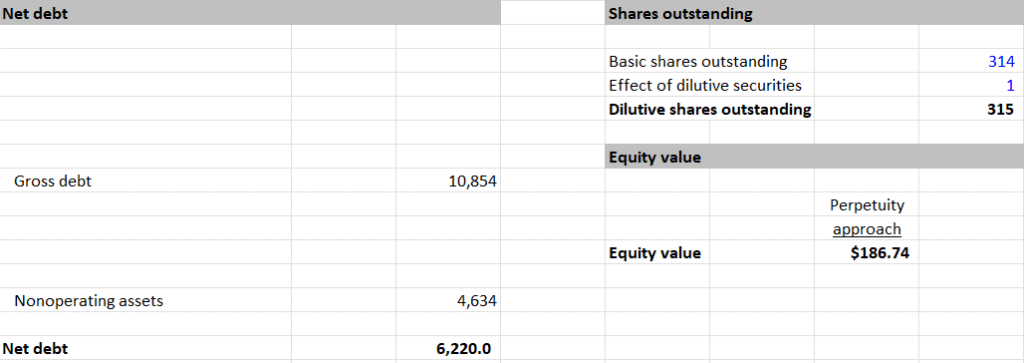

- Net Debt: $6,220

- Equity Value: $58,854

- Shares Outstanding: 314M

- Intrinsic Value per Share: $186.74

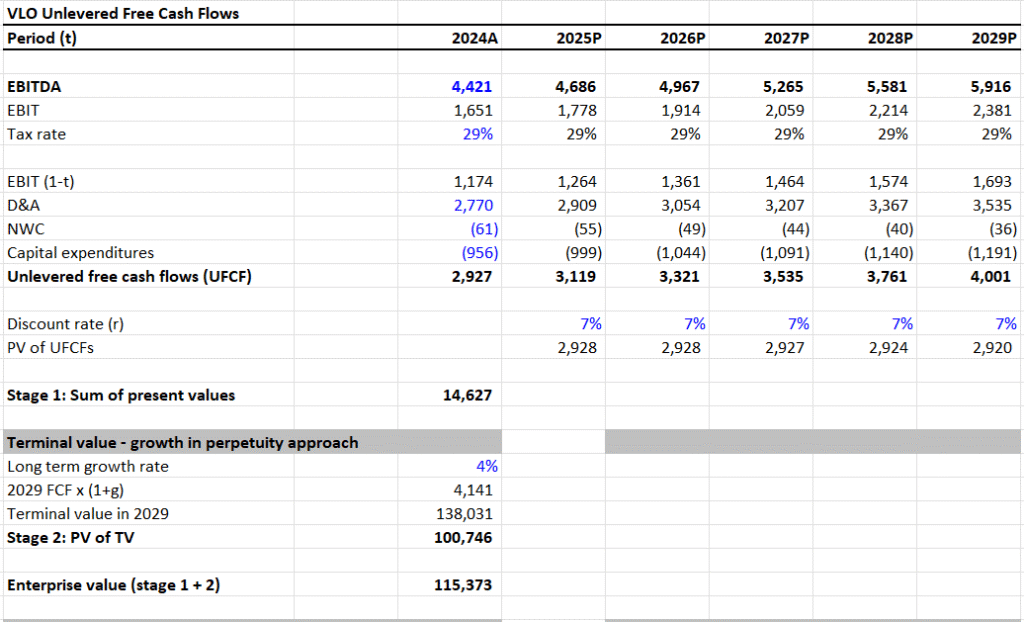

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $14,627

- Terminal Value (TV): $138,031

- PV of Terminal Value: $100,746

- Enterprise Value (EV): $115,373

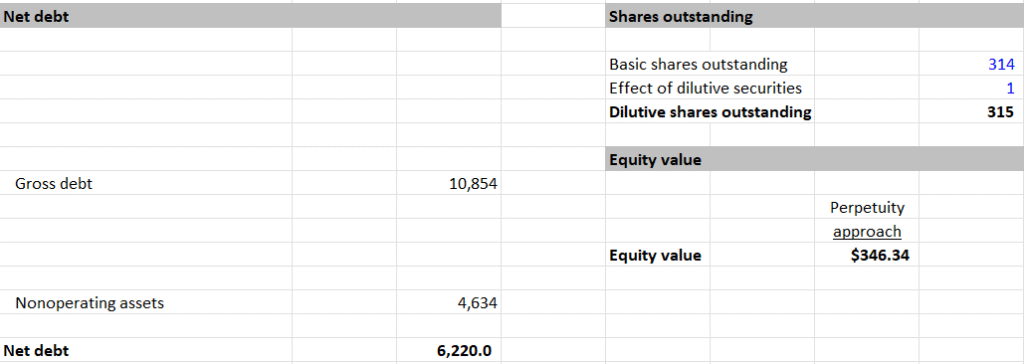

- Net Debt: $6,220

- Equity Value: $109,153

- Shares Outstanding: 314M

- Intrinsic Value per Share: $346.34

IV. Valuation Summary and Upside Potential

- Current Price: $143.74

- Bear Case Intrinsic Value: $109.84 → -23.6% downside

- Base Case Intrinsic Value: $186.74 → 29.9% upside

- Bull Case Intrinsic Value: $346.34 → 141% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $4.34

- Shares Outstanding: 314M

- Total Dividends Paid: 314 × 4.34 = $1,362M

- Free Cash Flow (Used for Analysis): $4,833M

- Dividend Payout Ratio (FCF Basis):

- $1,362 / $4,833 = 0.2817 or ~28.2%

- Assessment:

- Payout ratio is conservative

- Company retains over 70% of FCF after dividends

- Conclusion: Dividend appears very sustainable, with ample room for growth or repurchase programs

VI. Summary View

This report is based purely on data-driven modeling and presents a range of fair values based on different economic conditions and growth outlooks.

- DCF Highlights: All scenarios suggest VLO is either fairly valued or significantly undervalued

- Dividend View: Strongly sustainable and supported by robust FCF

- Quantitative Takeaway: VLO presents a compelling long-term opportunity for investors seeking both value and income

Valuation Range: $109.84 – $346.34

VICI Properties: An Alpha Stock for Income Investors and Beginners Seeking Strong Buy Stocks Today