Currently trading at $151, Qualcomm (NASDAQ: QCOM) may be one of the stocks that are about to go up, based on this detailed investing research report. Using a scenario-driven Discounted Cash Flow (DCF) model across Bear, Base, and Bull cases, we estimate the true intrinsic value of stock well above current levels. This analysis also includes a review of dividend sustainability, offering key insights for those focused on shares and investments. If you’re looking for quality stocks on sale backed by strong fundamentals, QCOM deserves a close look.

All figures are in millions of USD unless otherwise stated.

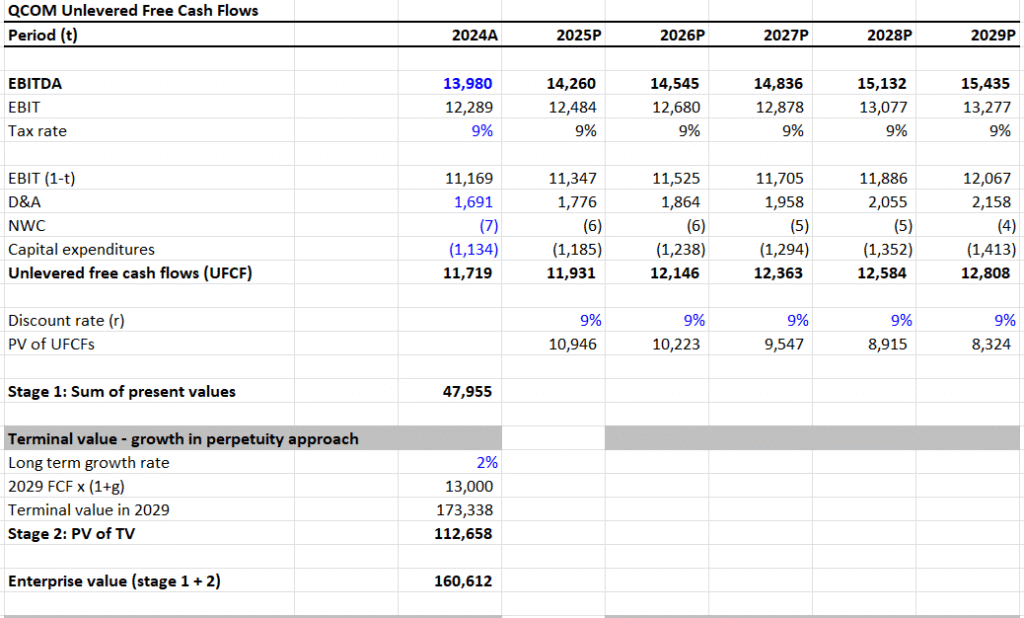

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $47,955

- Terminal Value (TV): $173,338

- PV of Terminal Value: $112,658

- Enterprise Value (EV): $160,612

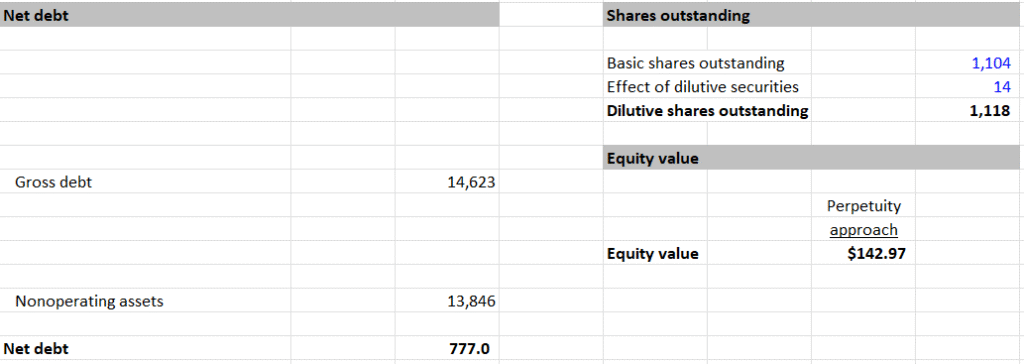

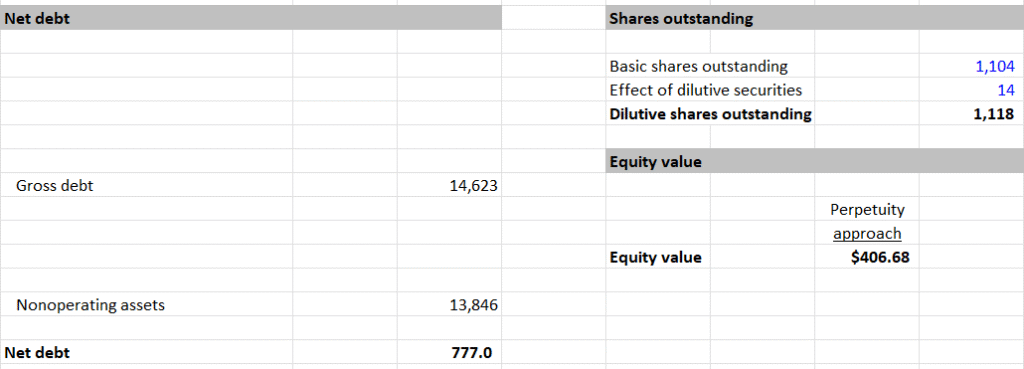

- Net Debt: $777

- Equity Value: $159,835

- Shares Outstanding: 1,104M

- Intrinsic Value per Share: $142.97

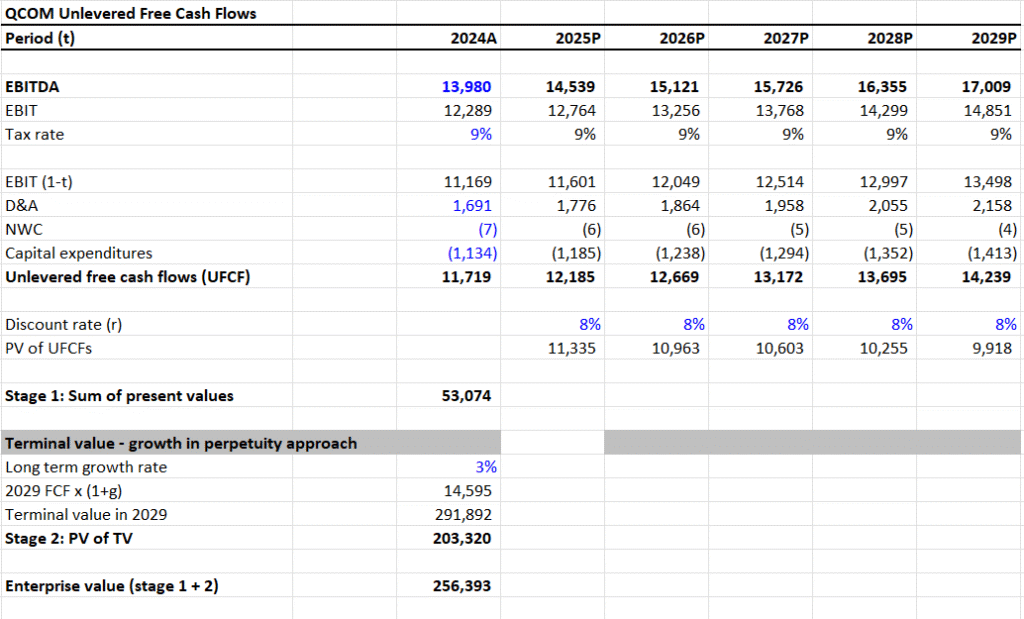

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $53,074

- Terminal Value (TV): $291,892

- PV of Terminal Value: $203,320

- Enterprise Value (EV): $256,393

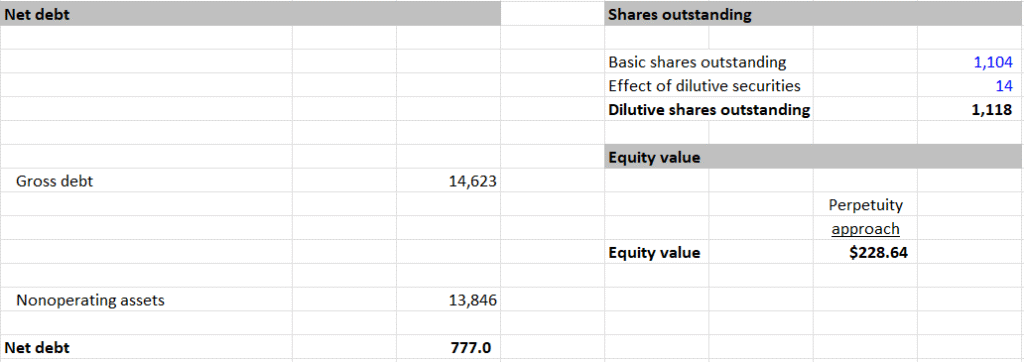

- Net Debt: $777

- Equity Value: $255,616

- Shares Outstanding: 1,104M

- Intrinsic Value per Share: $228.64

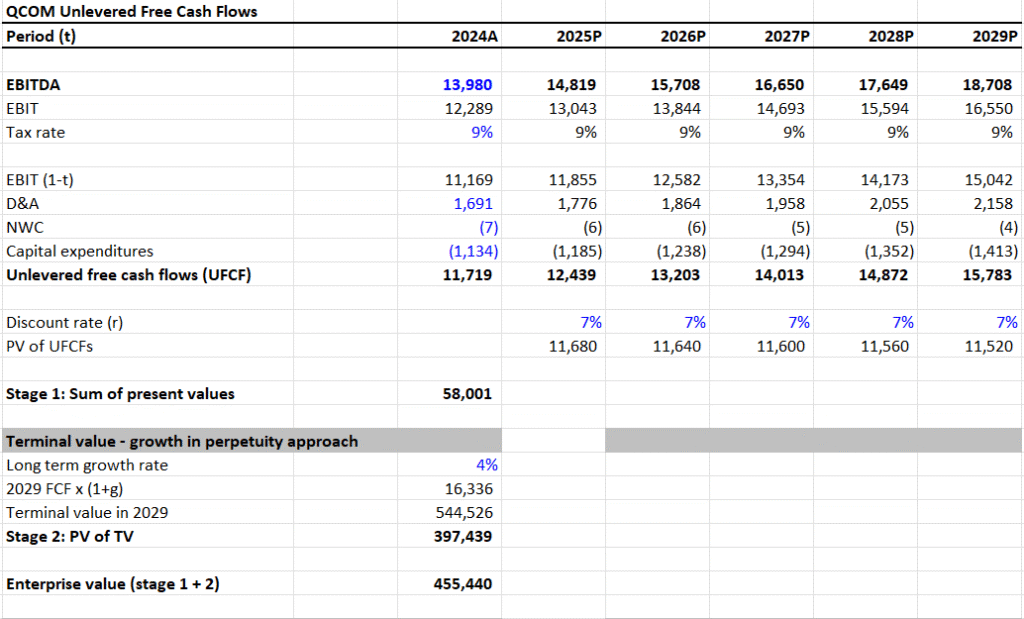

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $58,001

- Terminal Value (TV): $544,526

- PV of Terminal Value: $397,439

- Enterprise Value (EV): $455,440

- Net Debt: $777

- Equity Value: $454,663

- Shares Outstanding: 1,104M

- Intrinsic Value per Share: $406.68

IV. Valuation Summary and Upside Potential

- Current Price: $151

- Bear Case Intrinsic Value: $142.97 → -5% downside

- Base Case Intrinsic Value: $228.64 → 51% upside

- Bull Case Intrinsic Value: $406.68 → 169% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $3.40

- Shares Outstanding: 1,104M

- Total Dividends Paid: 1,104 × 3.40 = $3,754M

- Free Cash Flow (Used for Analysis): $11,706M

- Dividend Payout Ratio (FCF Basis):

- $3,754 / $11,706 = 0.32 or ~32%

- Assessment:

- Dividend payout is conservative

- Over two-thirds of FCF is retained, allowing flexibility for reinvestment or increased shareholder returns

- Conclusion: Dividend is sustainable, with a moderate payout ratio

VI. Summary View

This analysis avoids forward-looking narrative and uses pure financial modeling to derive an equity value range.

- DCF Takeaway: Valuation scenarios highlight substantial upside from the current market price

- Dividend Outlook: Conservative payout ratio supports dividend durability

- Quantitative Conclusion: QCOM is undervalued under Base and Bull scenarios with 51% to 169% upside

Valuation Range: $142.97 – $406