For investors focused on public investing and long-term opportunities, The Progressive Corporation (NYSE: PGR), currently trading at $277, may be one of the top stocks to buy right now. This report delivers a scenario based Discounted Cash Flow (DCF) valuation covering Bear, Base, and Bull cases to determine the true intrinsic value of this alpha stock. It also evaluates dividend sustainability through a deep analysis of Free Cash Flow (FCF), making PGR a compelling option for those investing in equities and seeking the best long term stocks for a resilient portfolio.

All figures are in millions of USD unless otherwise stated.

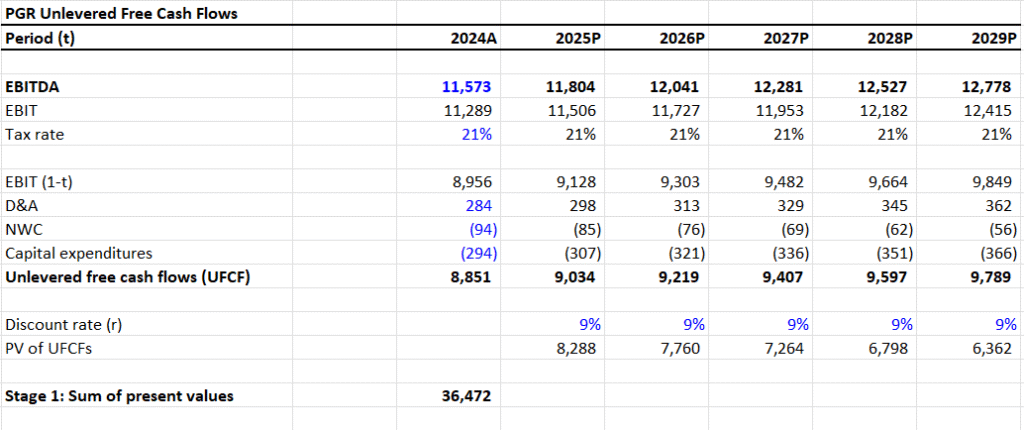

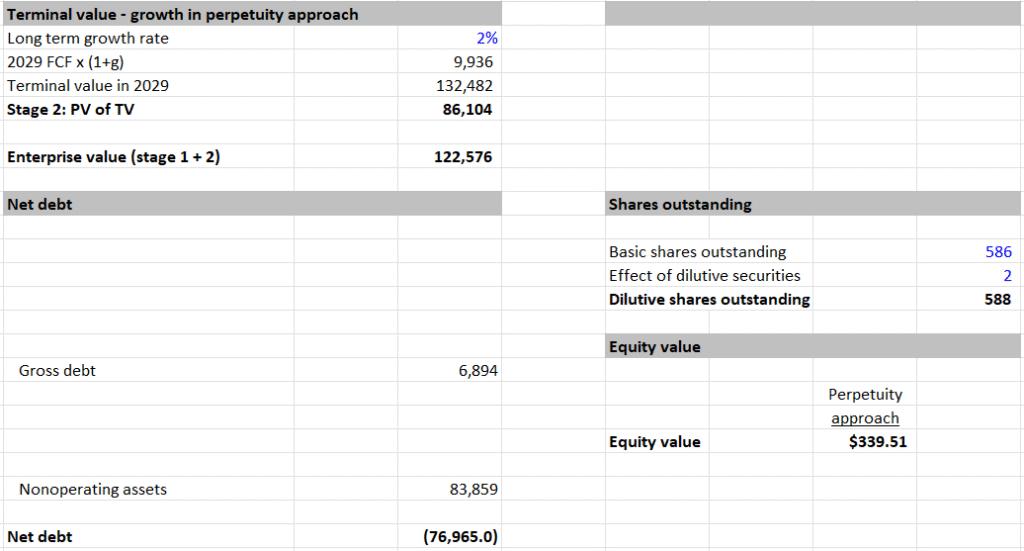

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $36,472

- Terminal Value (TV): $132,482

- PV of Terminal Value: $86,104

- Enterprise Value (EV): $122,576

- Net Debt: $76,965

- Equity Value: $45,611

- Shares Outstanding: 586M

- Intrinsic Value per Share: $339.51

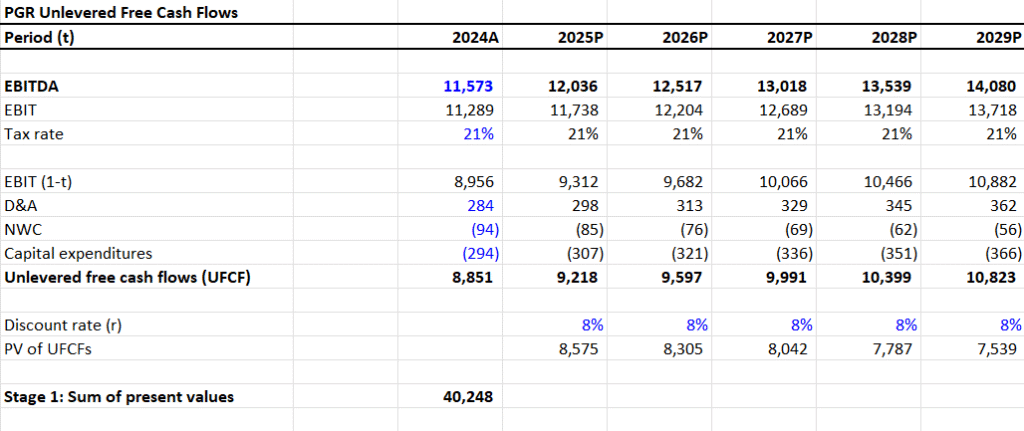

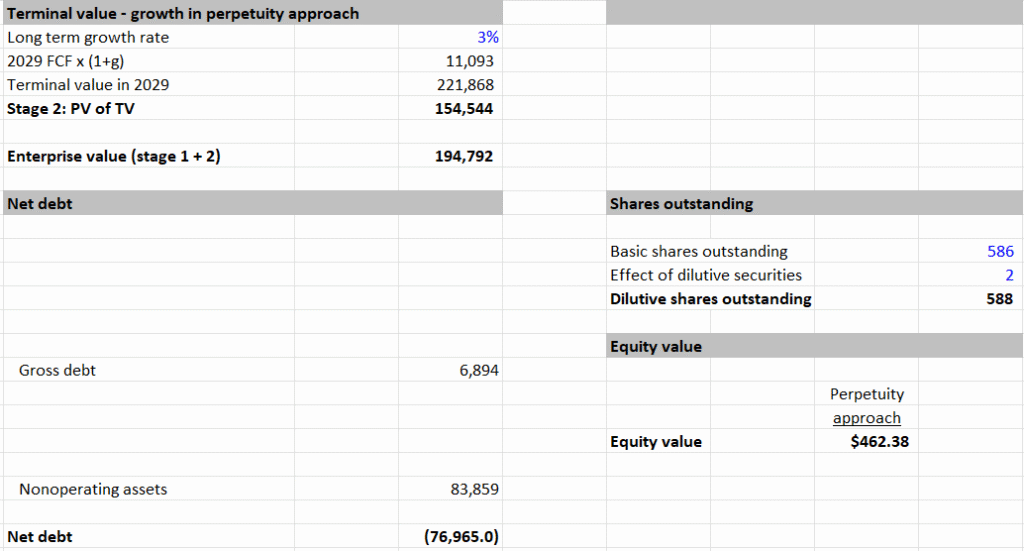

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $40,248

- Terminal Value (TV): $221,868

- PV of Terminal Value: $154,544

- Enterprise Value (EV): $194,792

- Net Debt: $76,965

- Equity Value: $117,827

- Shares Outstanding: 586M

- Intrinsic Value per Share: $462.38

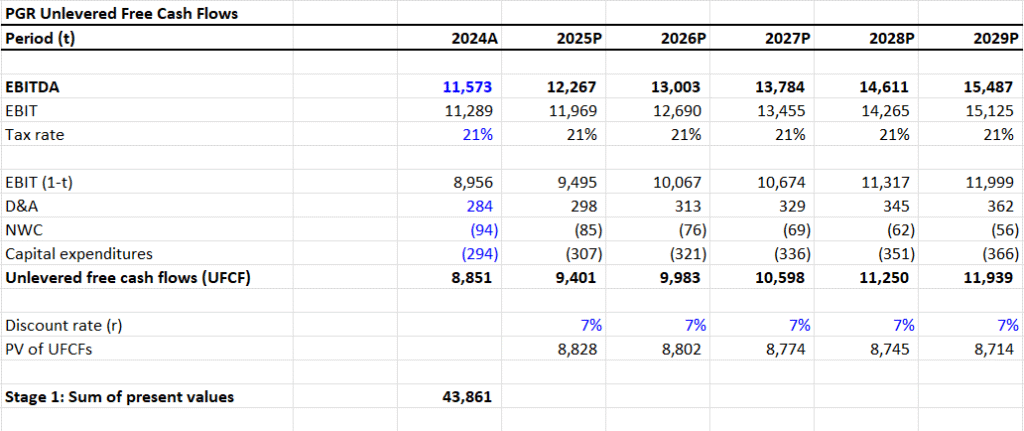

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $43,861

- Terminal Value (TV): $411,894

- PV of Terminal Value: $300,634

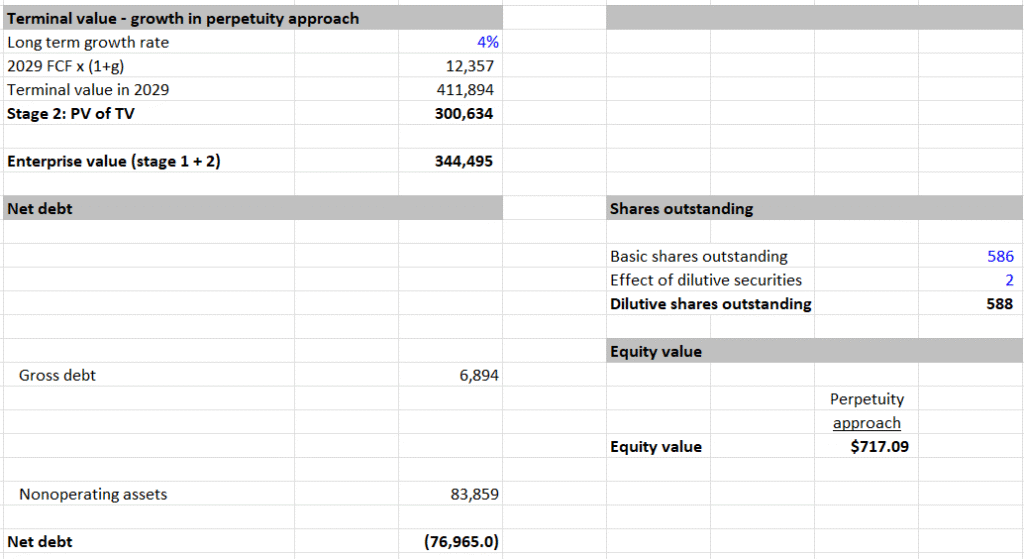

- Enterprise Value (EV): $344,495

- Net Debt: $76,965

- Equity Value: $267,530

- Shares Outstanding: 586M

- Intrinsic Value per Share: $717.09

IV. Valuation Summary and Upside Potential

- Current Price: $277

- Bear Case Intrinsic Value: $339.51 → 23% upside

- Base Case Intrinsic Value: $462.38 → 67% upside

- Bull Case Intrinsic Value: $717.09 → 159% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $4.90

- Shares Outstanding: 586M

- Total Dividends Paid: 586 × 4.90 = $2,871M

- Free Cash Flow (Used for Analysis): $15,733M

- Dividend Payout Ratio (FCF Basis):

- $2,871 / $15,733 = 0.182 or ~18.2%

- Assessment:

- Payout ratio is very low, leaving over 80% of FCF retained

- Significant cushion to maintain or increase dividends even in lower UFCF scenarios

- Conclusion: Dividend appears highly sustainable with ample coverage by free cash flow

VI. Summary View

This analysis maintains a strict data-centric discipline. Each scenario represents a clearly defined outlook in terms of macroeconomic assumptions and company performance.

- DCF Takeaway: At $277, PGR trades significantly below its modeled fair value under every scenario

- Dividend Outlook: Excellent sustainability, with only 18% of FCF required to cover dividends

- Quantitative Conclusion: PGR appears undervalued in all modeled cases, with upside ranging from 23% to 159%

Valuation Range: $339.51 – $717.09

PayPal (PYPL) Stock Analysis: Strong Upside Potential Revealed Through DCF Valuation (2025)