In this blog focused on stocks and investing, we present a data-driven valuation of The Hartford Financial Services Group (NYSE: HIG) using a three-scenario Discounted Cash Flow (DCF) model—Bear, Base, and Bull cases. This analysis highlights the intrinsic value of HIG and shows how company stocks can be evaluated using reliable investing tools. Whether you’re learning stocks how to invest or refining your valuation strategy, this post offers a clear, practical approach to assessing long-term value through cash flow and dividend sustainability metrics.

All figures are in millions of USD unless otherwise stated.

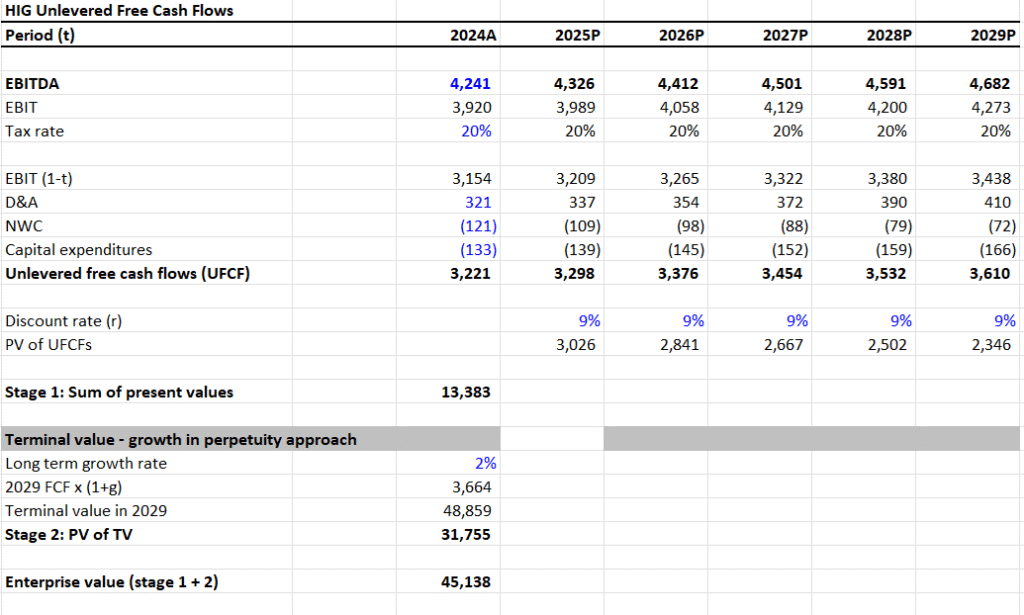

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $13,383

- Terminal Value (TV): $48,859

- PV of Terminal Value: $31,755

- Enterprise Value (EV): $45,138

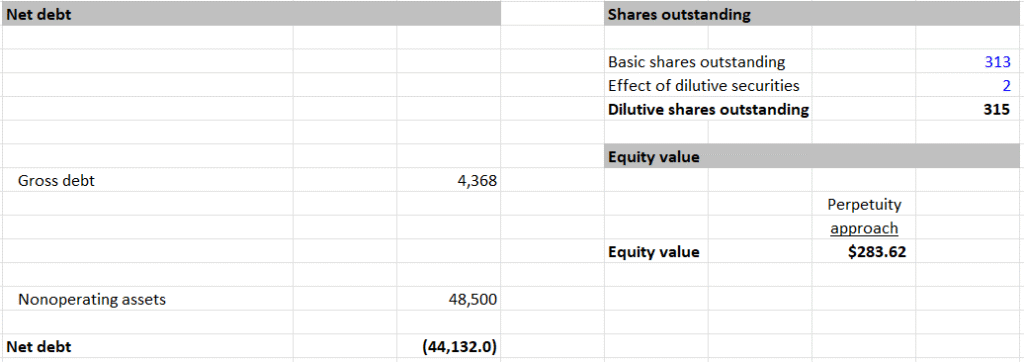

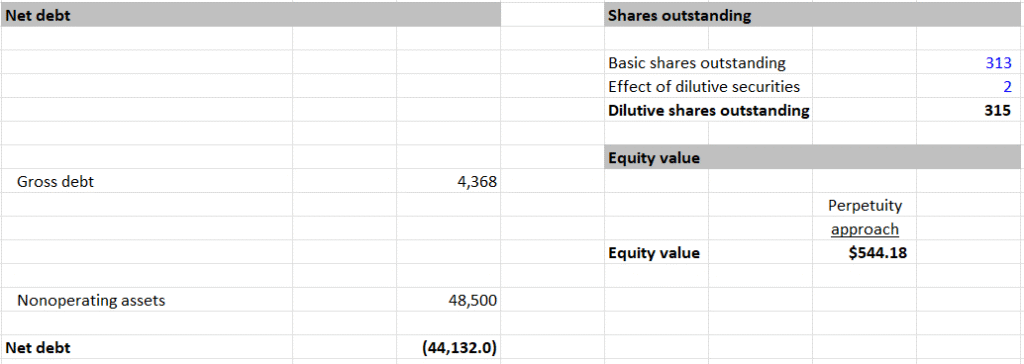

- Net Debt: -$44,132

- Equity Value: $89,270

- Shares Outstanding: 315M

- Intrinsic Value per Share: $283.62

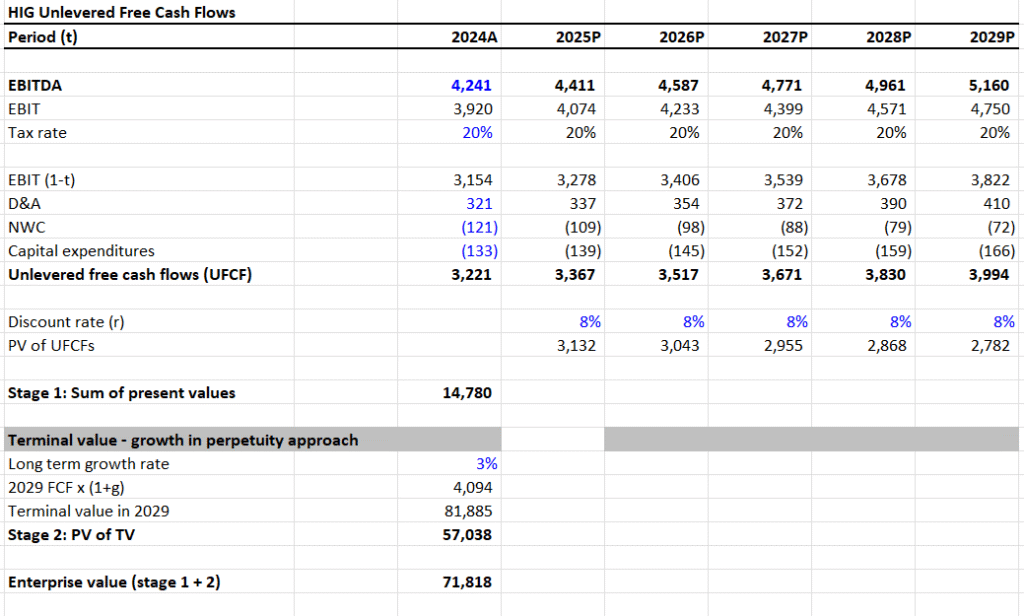

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $14,780

- Terminal Value (TV): $81,885

- PV of Terminal Value: $57,038

- Enterprise Value (EV): $71,818

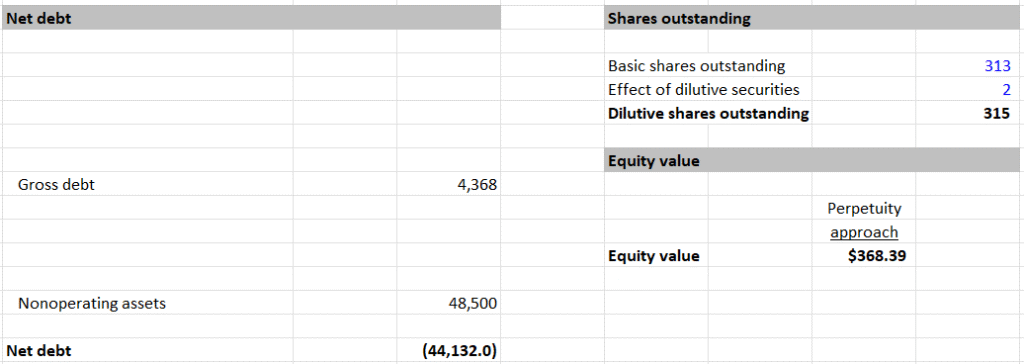

- Net Debt: -$44,132

- Equity Value: $115,950

- Shares Outstanding: 315M

- Intrinsic Value per Share: $368.39

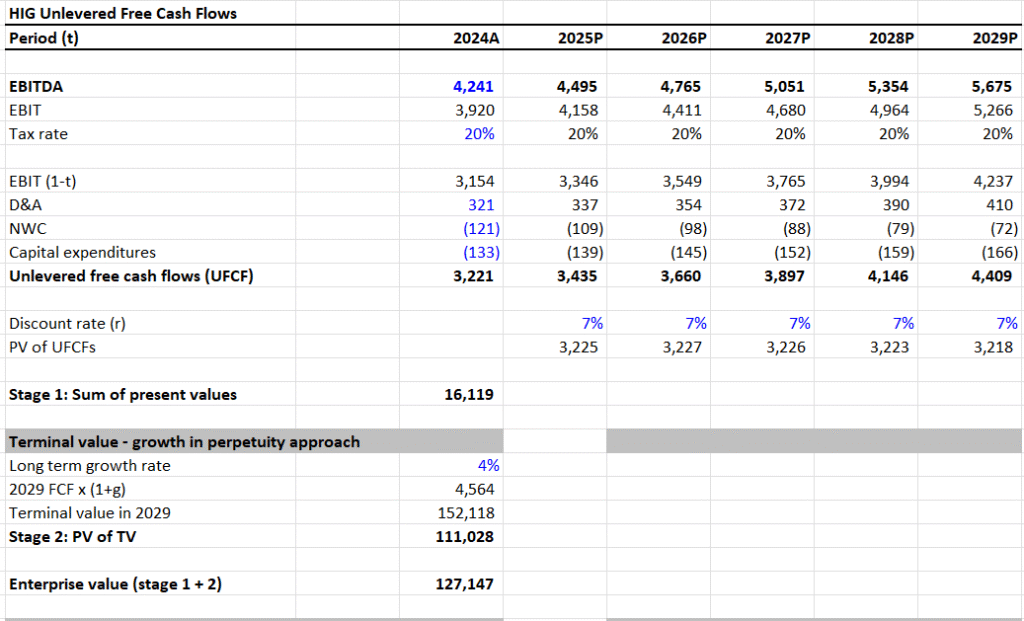

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $16,119

- Terminal Value (TV): $152,118

- PV of Terminal Value: $111,028

- Enterprise Value (EV): $127,147

- Net Debt: -$44,132

- Equity Value: $171,279

- Shares Outstanding: 315M

- Intrinsic Value per Share: $544.18

IV. Valuation Summary and Upside Potential

- Current Price: $126

- Bear Case Intrinsic Value: $283.62 → 125% upside

- Base Case Intrinsic Value: $368.39 → 192% upside

- Bull Case Intrinsic Value: $544.18 → 332% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $1.98

- Shares Outstanding: 315M

- Total Dividends Paid: 315 × 1.98 = $624M

- Free Cash Flow (Used for Analysis): $5,664M

- Dividend Payout Ratio (FCF Basis):

- $624 / $5,664 = 0.11 or ~11%

- Assessment:

- Extremely low payout ratio

- Substantial retained cash flow supports dividend safety and future increases

- Conclusion: Dividend appears very secure under current financials

VI. Summary View

This valuation relies solely on scenario-driven DCF modeling and dividend sustainability metrics, avoiding speculative narratives. Each case reflects assumptions about future growth, market risk, and reinvestment economics.

- DCF Highlight: HIG trades significantly below intrinsic value across all scenarios

- Dividend View: Low payout ratio ensures excellent dividend coverage

- Quantitative Takeaway: At $126, HIG presents strong potential value with high margin of safety

Valuation Range: $283.62 – $544.18