Discover an in-depth DCF valuation and dividend sustainability analysis of Elevance Health (ELV), perfect for anyone exploring share market investment for beginners. This report covers the best investing strategy with data-backed projections, helping you get stocks that show long-term value. Learn about a strong stock to invest in today, with clear upside potential across conservative, base, and bullish cases. Whether you’re investing into stocks for beginners or looking for disciplined financial analysis, this guide equips you with valuable insights for smarter decisions in today’s dynamic market.

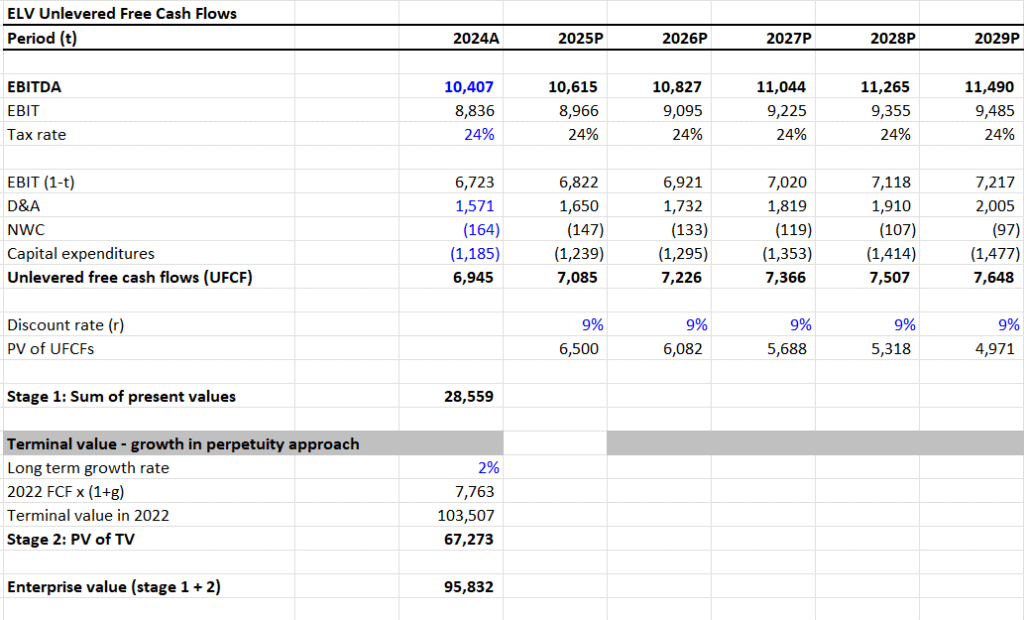

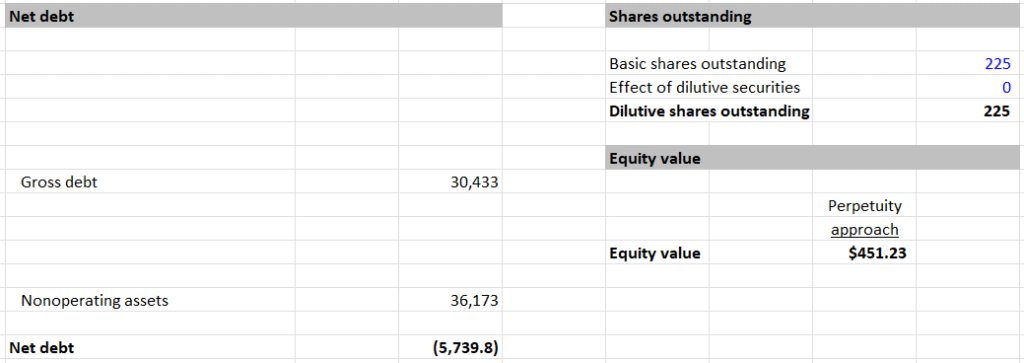

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $28,559

- Terminal Value (TV): $103,507

- PV of Terminal Value: $67,273

- Enterprise Value (EV): $95,832

- Net Debt: -$5,739.8

- Equity Value: $101,572

- Shares Outstanding: 225M

- Intrinsic Value per Share: $451.23

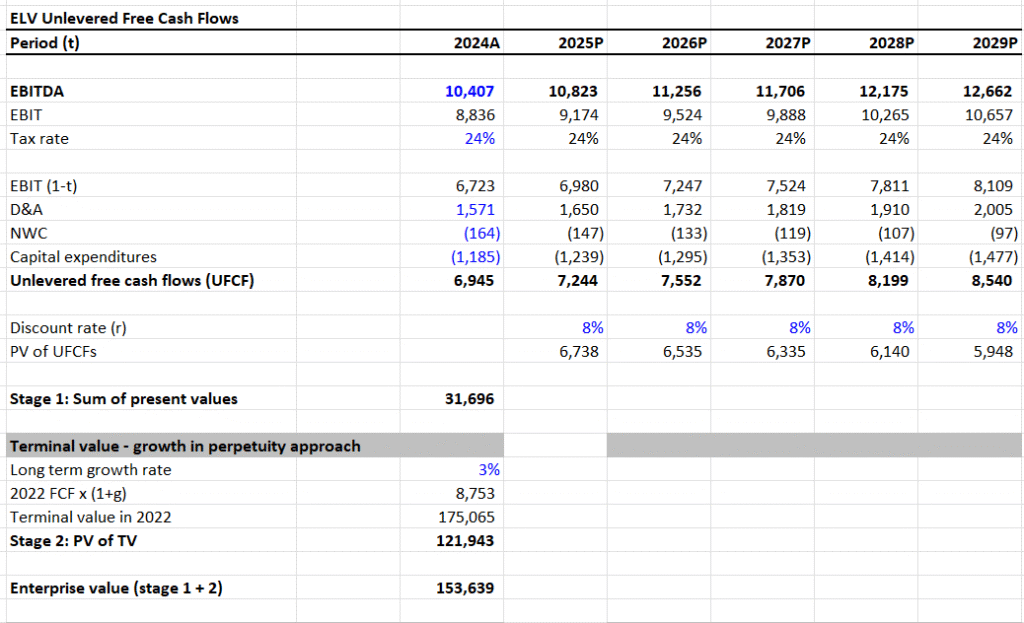

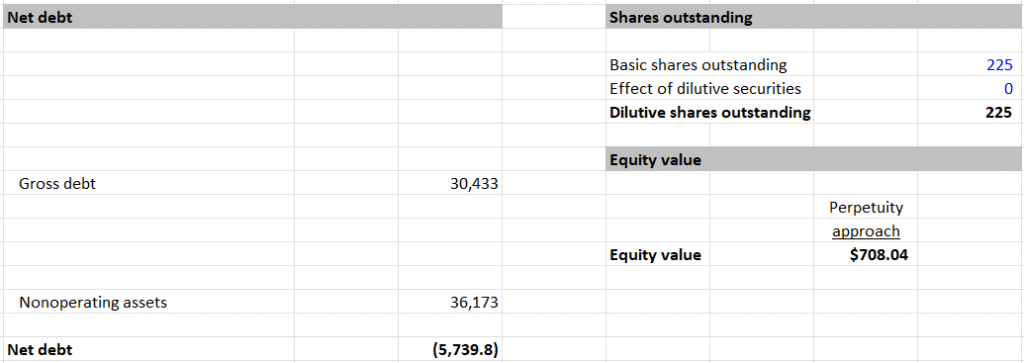

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $31,696

- Terminal Value (TV): $175,065

- PV of Terminal Value: $121,943

- Enterprise Value (EV): $153,639

- Net Debt: -$5,739.8

- Equity Value: $159,378

- Shares Outstanding: 225M

- Intrinsic Value per Share: $708.04

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $34,730

- Terminal Value (TV): $327,835

- PV of Terminal Value: $239,280

- Enterprise Value (EV): $274,010

- Net Debt: -$5,739.8

- Equity Value: $279,750

- Shares Outstanding: 225M

- Intrinsic Value per Share: $1242.78

IV. Valuation Summary and Upside Potential

- Current Price: $277

- Bear Case Intrinsic Value: $451.23 → 63% upside

- Base Case Intrinsic Value: $708.04 → 155% upside

- Bull Case Intrinsic Value: $1242.78 → 349% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $7.08

- Shares Outstanding: 225M

- Total Dividends Paid: 225 × 7.08 = $1,593M

- Free Cash Flow (Used for Analysis): $5,567.73M

- Dividend Payout Ratio (FCF Basis):

- $1,593 / $5,567.73 = 0.286 or ~29%

- Assessment:

- Conservative payout ratio with significant free cash flow retention.

- Supports both dividends and business reinvestment.

- Conclusion: Dividend is highly sustainable with substantial room for future increases.

VI. Summary View

Based on our quantitative valuation model, Elevance Health shows robust upside potential across all scenarios, especially when considering current market valuation. Dividend payouts are modest relative to free cash flow, enhancing long-term sustainability.