Looking for reliable companies to invest in? This blog presents a data-driven valuation of D.R. Horton (NYSE: DHI), one of the most compelling long term investment stocks. Using a scenario based Discounted Cash Flow (DCF) model covering Bear, Base, and Bull cases—the analysis uncovers DHI as a potentially undervalued stock. We also evaluate the sustainability of its dividend using free cash flow projections, making this a must-read for anyone investing in shares or building a portfolio of stable stock shares.

All figures are in millions of USD unless otherwise stated.

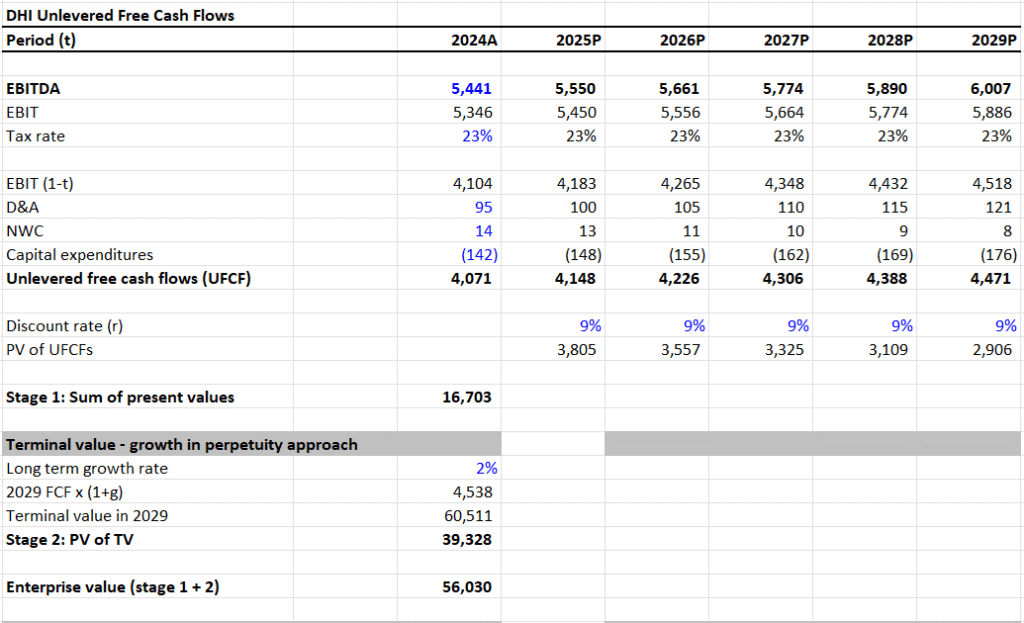

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $16,703

- Terminal Value (TV): $60,511

- PV of Terminal Value: $39,328

- Enterprise Value (EV): $56,030

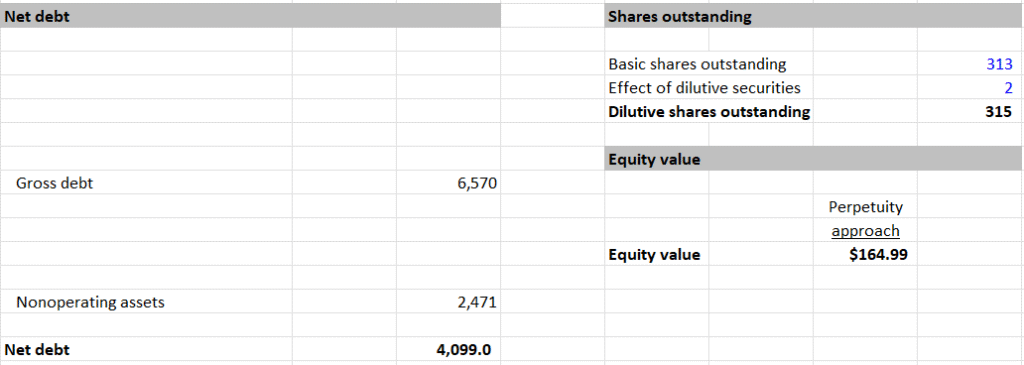

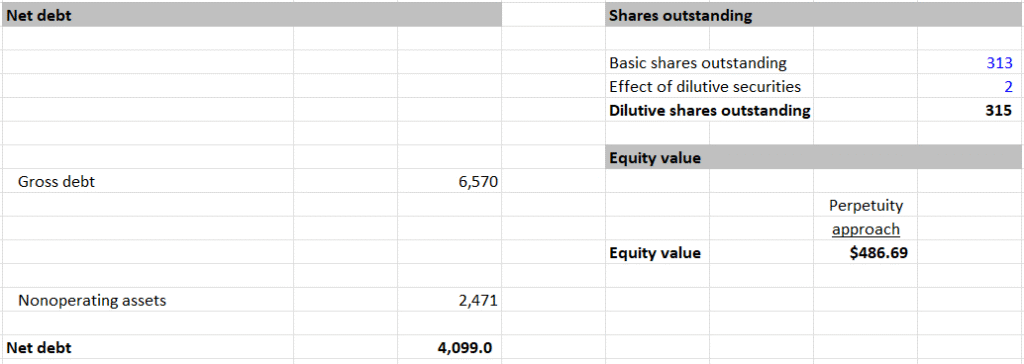

- Net Debt: $4,099

- Equity Value: $51,931

- Shares Outstanding: 315M

- Intrinsic Value per Share: $164.99

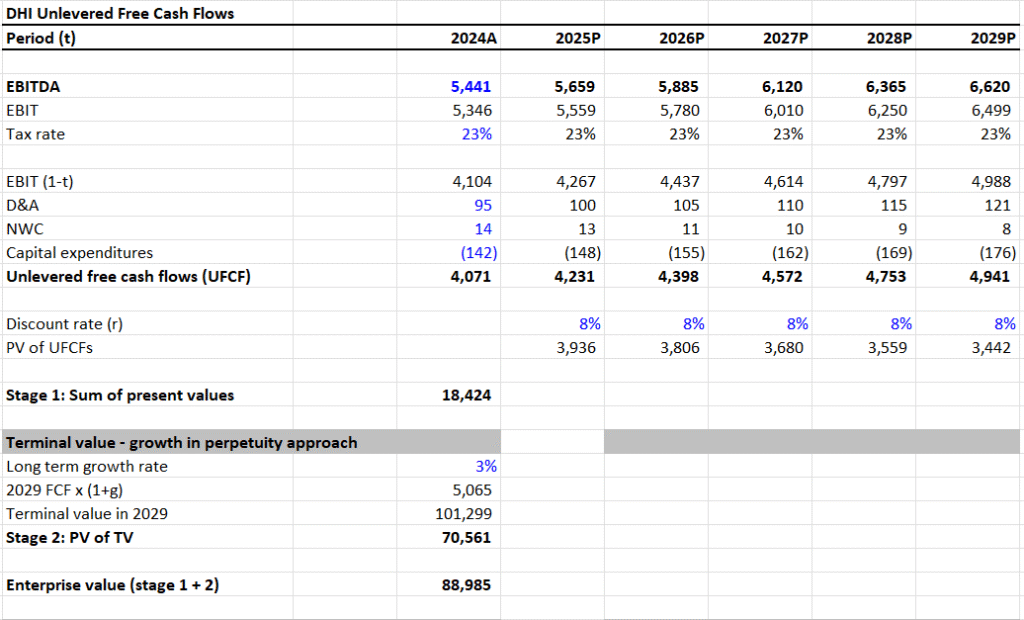

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $18,424

- Terminal Value (TV): $101,299

- PV of Terminal Value: $70,561

- Enterprise Value (EV): $88,985

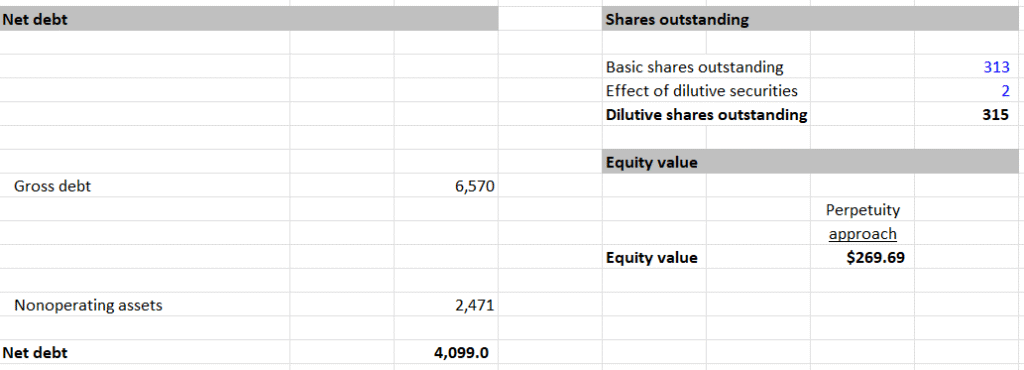

- Net Debt: $4,099

- Equity Value: $84,886

- Shares Outstanding: 315M

- Intrinsic Value per Share: $269.69

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $20,071

- Terminal Value (TV): $187,996

- PV of Terminal Value: $137,215

- Enterprise Value (EV): $157,285

- Net Debt: $4,099

- Equity Value: $153,186

- Shares Outstanding: 315M

- Intrinsic Value per Share: $486.69

IV. Valuation Summary and Upside Potential

- Current Price: $124.20

- Bear Case Intrinsic Value: $164.99 → 33% upside

- Base Case Intrinsic Value: $269.69 → 117% upside

- Bull Case Intrinsic Value: $486.69 → 292% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $1.40

- Shares Outstanding: 315M

- Total Dividends Paid: 315 × 1.40 = $441M

- Free Cash Flow (Used for Analysis): $2,729M

- Dividend Payout Ratio (FCF Basis):

- $441 / $2,729 = 0.161 or ~16.1%

- Assessment:

- Payout ratio is very low, indicating substantial buffer

- The company retains 84%+ of FCF post dividends, signaling high flexibility

- Conclusion: Dividend appears very sustainable, with strong headroom for growth or reinvestment

VI. Summary View

This report avoids narrative and remains grounded in a quantitative, scenario-driven framework. Each case reflects a different assumption set for growth, risk, and capital structure, offering a robust view of valuation bands.

- DCF Highlights: DHI trades below its modeled fair value under all three cases

- Dividend View: Strong and secure, with a 16% payout ratio

- Quantitative Takeaway: At $124.20, DHI’s market price reflects pessimism not supported by intrinsic forecasts

Valuation Range: $164.99 – $486.69

EOG Resources: One of the Hottest Value Stocks? DCF Valuation Suggests Upside (2025)