In today’s investing market, identifying good stocks with strong upside potential is key. This report uses a data-driven approach and an intrinsic value calculator through a Discounted Cash Flow (DCF) model to evaluate ConocoPhillips (NYSE: COP). With a current trading price of $95 and a fair value range between $121 and $241 across Base and Bull scenarios, COP emerges as one of the strong buy stocks worth watching. The analysis also includes a dividend sustainability check based on projected free cash flow making this a must-read for serious investors focused on accurate stock valuation.

All figures are in millions of USD unless otherwise stated.

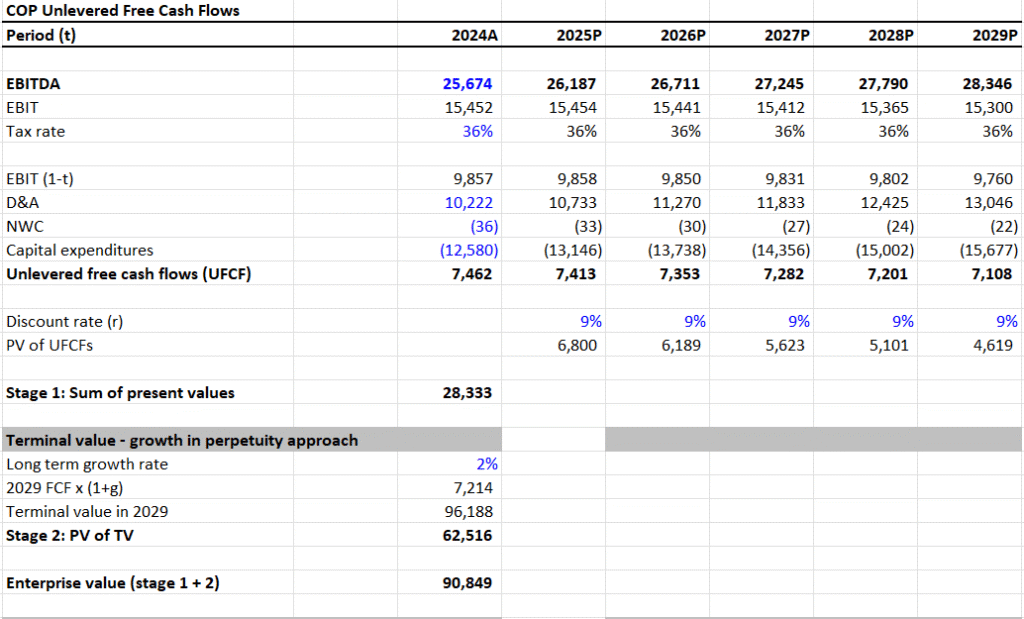

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $28,333

- Terminal Value (TV): $96,188

- PV of Terminal Value: $62,516

- Enterprise Value (EV): $90,849

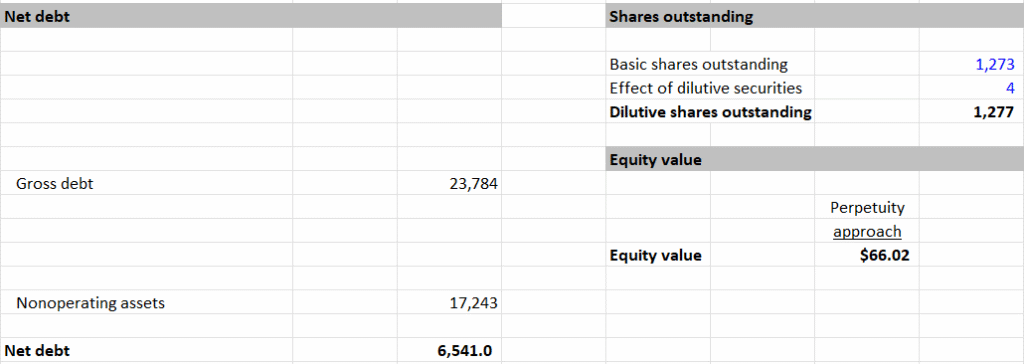

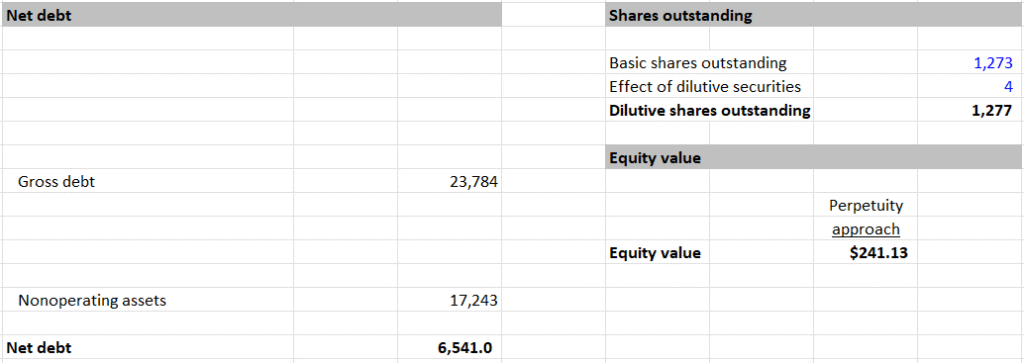

- Net Debt: $6,541

- Equity Value: $84,308

- Shares Outstanding: 1,277M

- Intrinsic Value per Share: $66.02

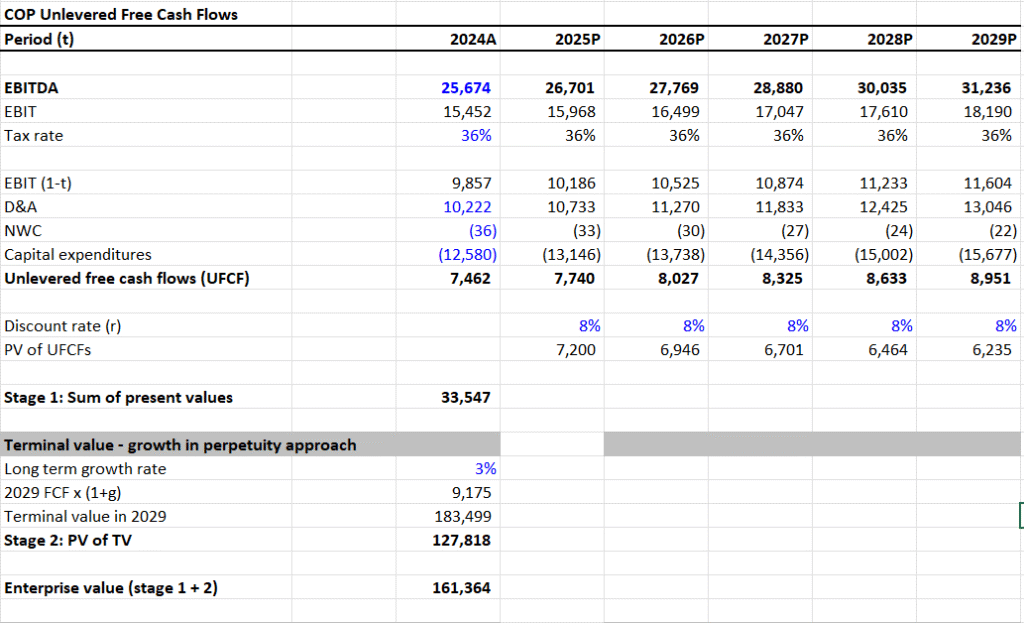

II. DCF Valuation — Base Case

EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $33,547

- Terminal Value (TV): $183,499

- PV of Terminal Value: $127,818

- Enterprise Value (EV): $161,364

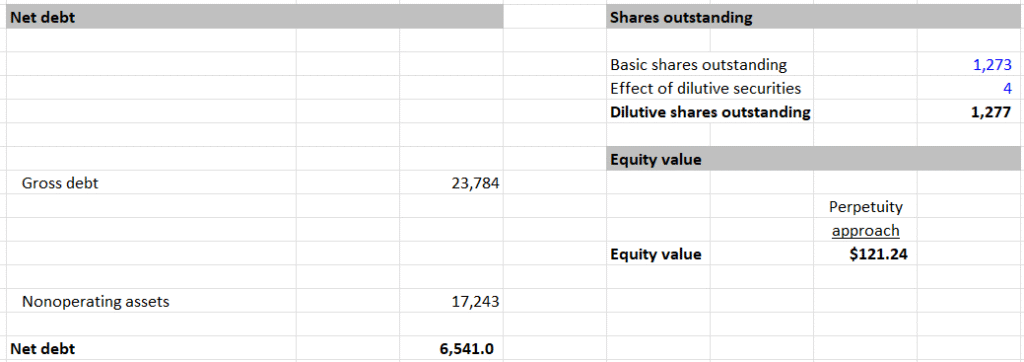

- Net Debt: $6,541

- Equity Value: $154,823

- Shares Outstanding: 1,277M

- Intrinsic Value per Share: $121.24

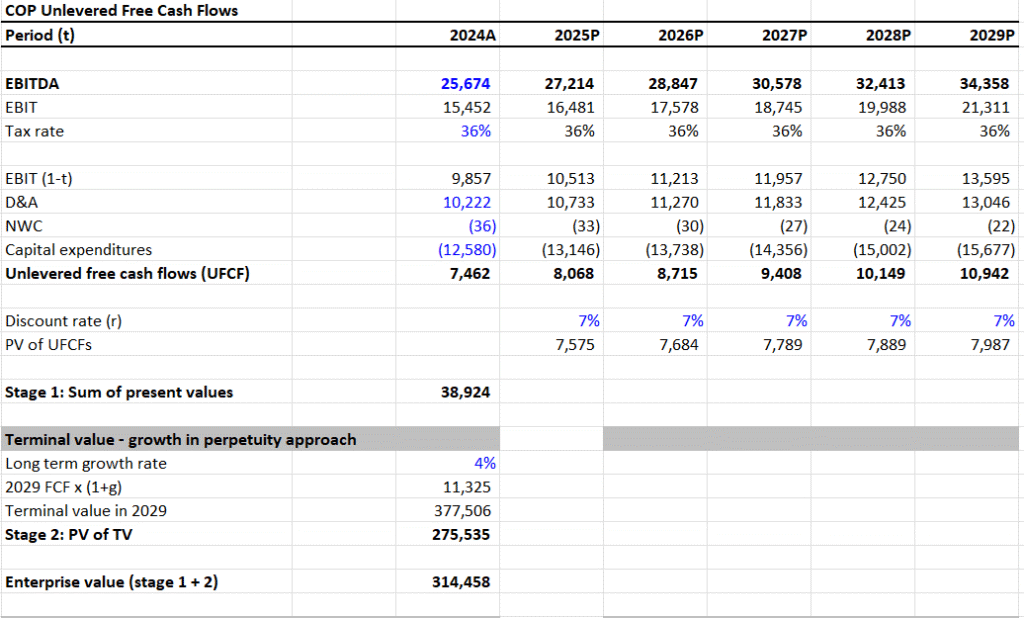

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $38,924

- Terminal Value (TV): $377,506

- PV of Terminal Value: $275,535

- Enterprise Value (EV): $314,458

- Net Debt: $6,541

- Equity Value: $307,917

- Shares Outstanding: 1,277M

- Intrinsic Value per Share: $241.13

IV. Valuation Summary and Upside Potential

- Current Price: $95

- Bear Case Intrinsic Value: $66.02 → -30.5% downside

- Base Case Intrinsic Value: $121.24 → 27.6% upside

- Bull Case Intrinsic Value: $241.13 → 154% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $3.12

- Shares Outstanding: 1,277M

- Total Dividends Paid: 1,277 × 3.12 = $3,985M

- Free Cash Flow (Used for Analysis): $8,674M

- Dividend Payout Ratio (FCF Basis):

- $3,985 / $8,674 = 0.459 or ~45.9%

- Assessment:

- Payout ratio remains below common red flags (>60%)

- Ample retained FCF ensures safety and future flexibility

- Conclusion: Dividend appears sustainable, with potential for continued payouts or increases

VI. Summary View

This report is strictly quantitative and based solely on modeled cash flows and balance sheet data. Each case presents a disciplined scenario set, with assumptions clearly outlined.

- DCF Highlights: COP shows considerable upside in both base and bull cases

- Dividend View: Dividend payout is reasonable and supported by cash flows

- Quantitative Takeaway: At $95, COP could offer significant value under more optimistic growth conditions

Valuation Range: $66.02 – $241.13

D.R. Horton (DHI): An Undervalued Stock With Strong Upside Across Scenarios (2025)