Discover a detailed valuation of Chevron Corporation (CVX), highlighted as the hottest stock to buy based on discounted cash flow analysis and dividend sustainability. Perfect for those using stock analysis sites and interested in stocks and investing for beginners, this breakdown offers clear insights into Chevron’s growth potential. Whether you are browsing good stock market websites or simply exploring stock market buying opportunities, this data-driven post provides a transparent look at one of the strongest long-term investments in today’s market.

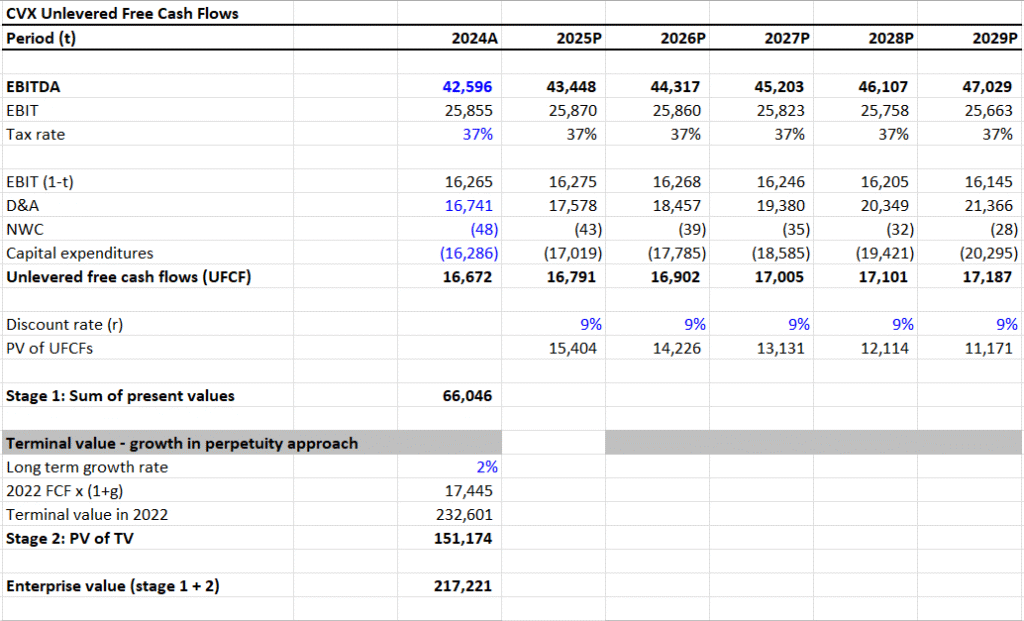

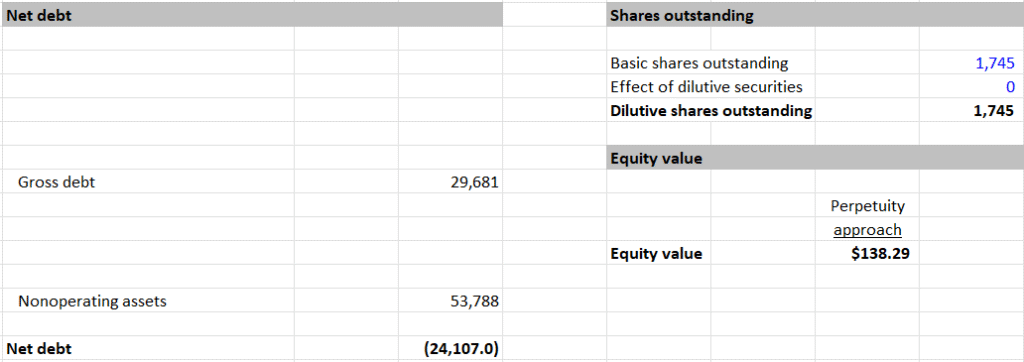

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $66,046

- Terminal Value (TV): $232,601

- PV of Terminal Value: $151,174

- Enterprise Value (EV): $217,221

- Net Debt: -$24,107

- Equity Value: $241,328

- Shares Outstanding: 1,745M

- Intrinsic Value per Share: $138.29

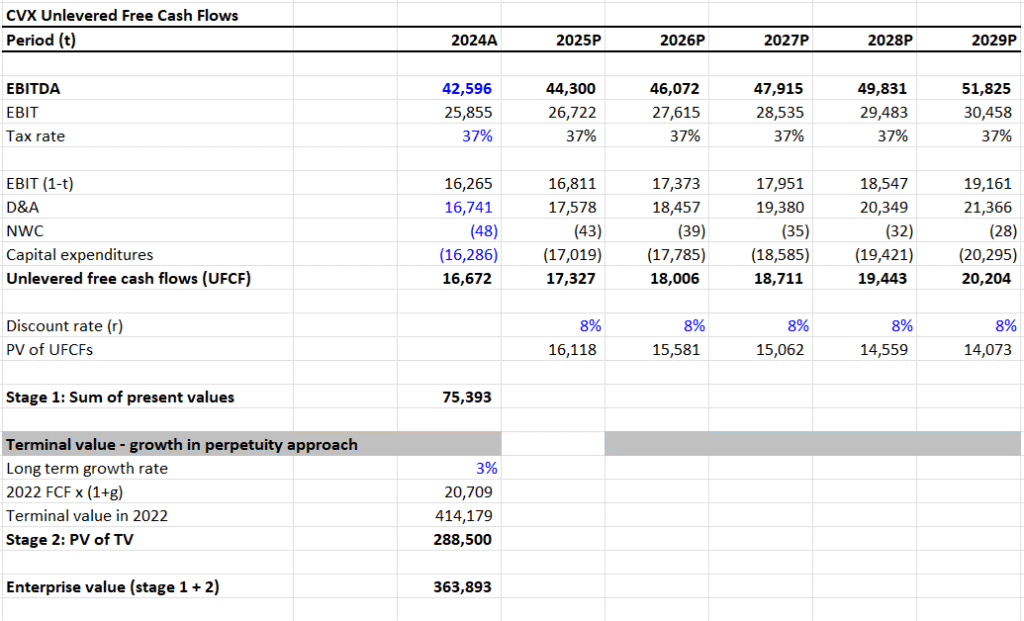

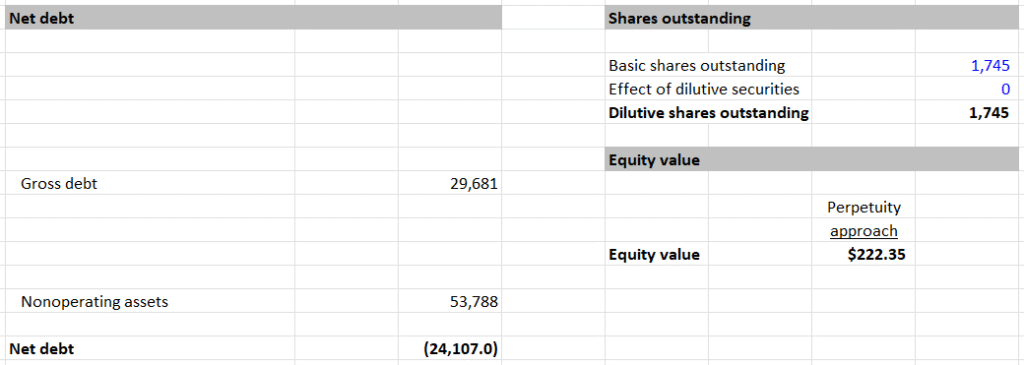

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $75,393

- Terminal Value (TV): $414,179

- PV of Terminal Value: $288,500

- Enterprise Value (EV): $363,893

- Net Debt: -$24,107

- Equity Value: $388,000

- Shares Outstanding: 1,745M

- Intrinsic Value per Share: $222.35

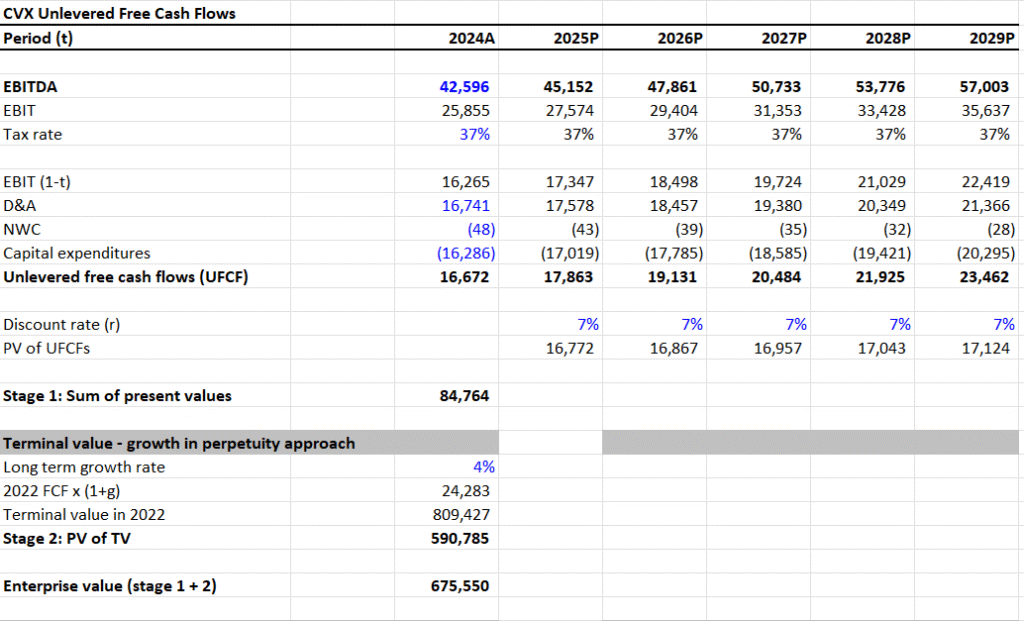

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $84,764

- Terminal Value (TV): $809,427

- PV of Terminal Value: $590,785

- Enterprise Value (EV): $675,550

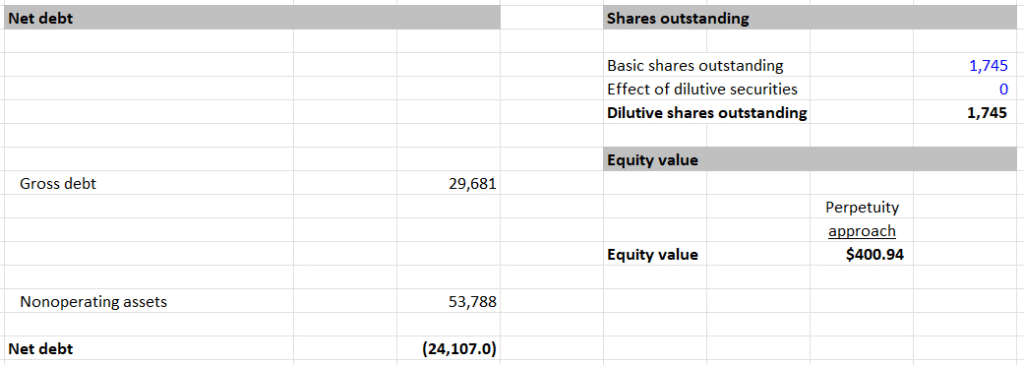

- Net Debt: -$24,107

- Equity Value: $699,657

- Shares Outstanding: 1,745M

- Intrinsic Value per Share: $400.94

IV. Valuation Summary and Upside Potential

- Current Price: $151.38

- Bear Case Intrinsic Value: $138.29 → -8.6% downside

- Base Case Intrinsic Value: $222.35 → 46.9% upside

- Bull Case Intrinsic Value: $400.94 → 164.7% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $6.60

- Shares Outstanding: 1,745M

- Total Dividends Paid: 1,745 × 6.60 = $11,517M

- Free Cash Flow (Used for Analysis): $13,567M

- Dividend Payout Ratio (FCF Basis):

- $11,517 / $13,567 = 0.85 or 85%

- Assessment:

- High payout ratio with limited retained cash flow.

- Dividend sustainability depends on continued robust cash flows.

- Conclusion: Dividend is currently sustainable, but future increases may be limited without substantial cash flow growth.

VI. Summary View

This quantitative analysis shows Chevron’s fair value under varying growth scenarios. While the bear case shows limited downside, the base and bull cases suggest substantial upside, supported by strong cash flow generation and a hefty dividend yield.

Valuation Range: $138.29 – $400.94

Check out – Best Things to Invest Into with Johnson & Johnson for Long-Term Growth (2025)