Dive into our investing research on Regeneron Pharmaceuticals, a standout pick among the best shares to invest in today. This detailed valuation analysis examines key financial projections to help identify stocks that are about to go up. Whether you’re new to buying stock market opportunities or a seasoned investor, this report offers practical insights into shares and investments that align with long-term growth strategies.

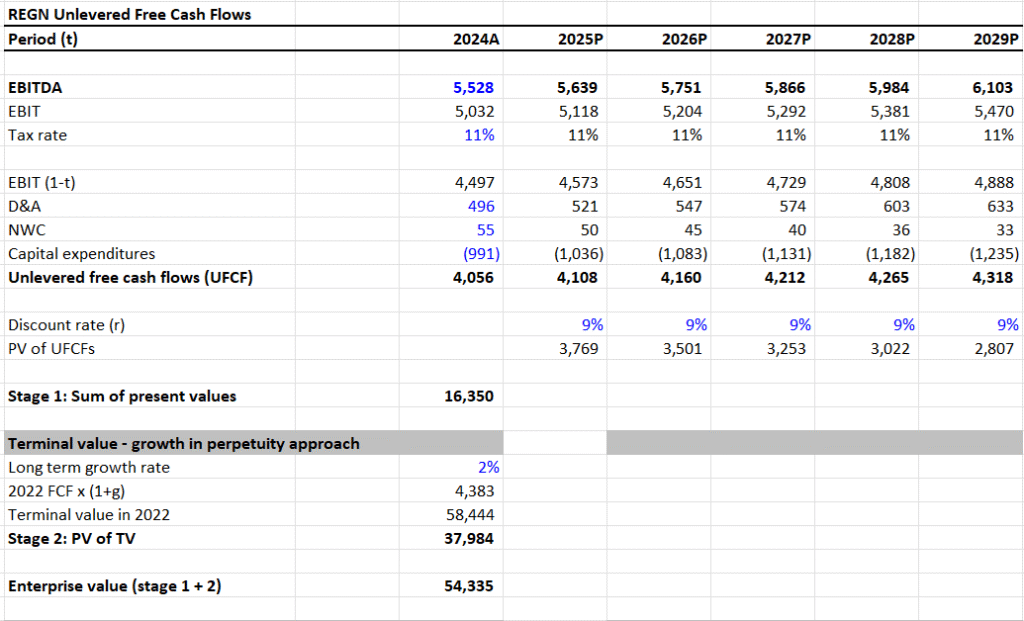

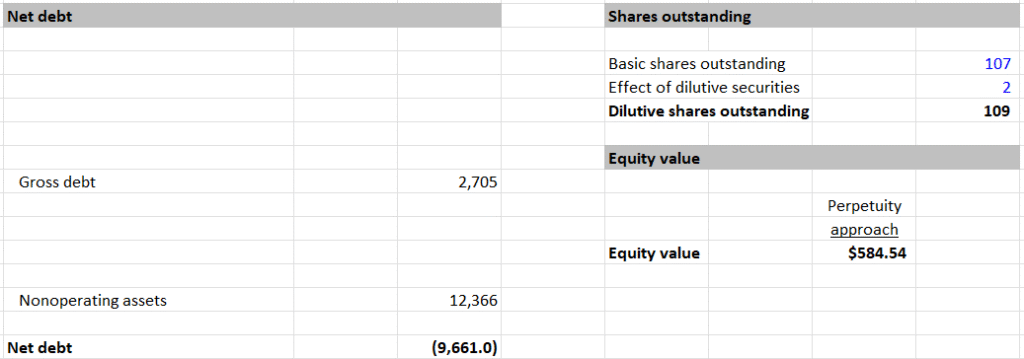

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- PV of UFCF (2024–2029): $16,350

- Terminal Value (TV): $58,444

- PV of Terminal Value: $37,984

- Enterprise Value (EV): $54,335

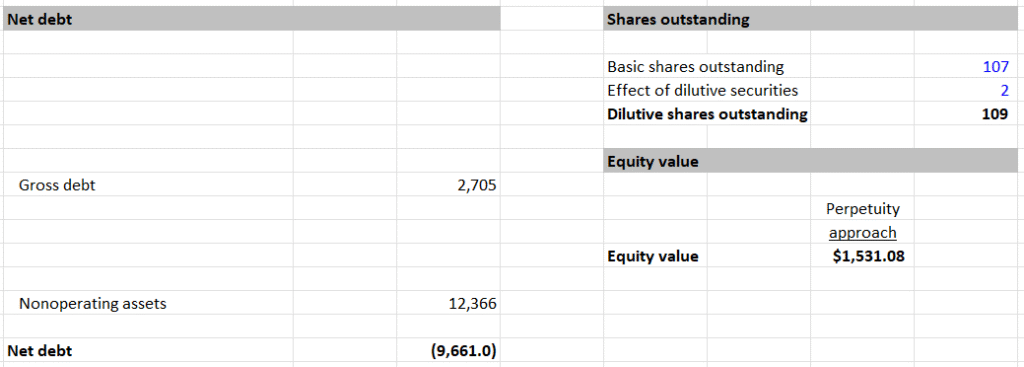

- Net Debt: -9,661

- Equity Value: $63,996

- Shares Outstanding: 109M

- Intrinsic Value per Share: $584.54

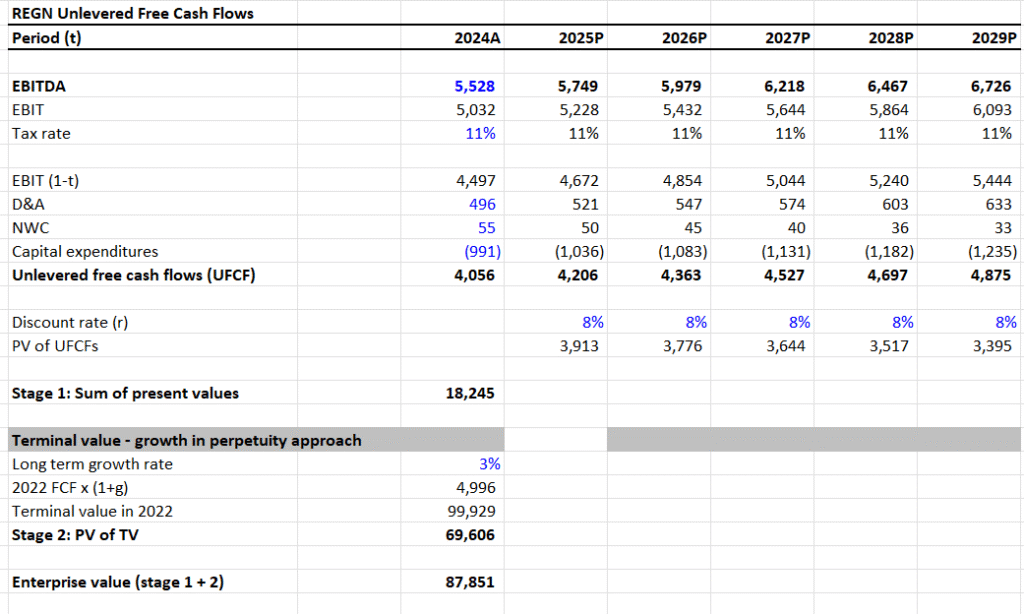

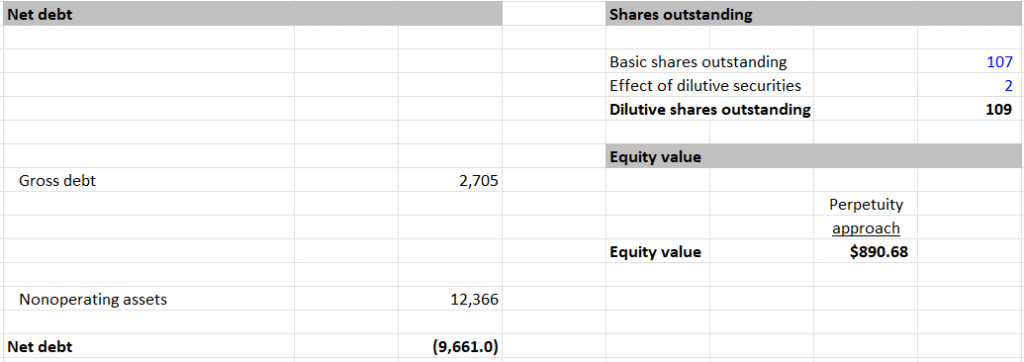

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- PV of UFCF (2024–2029): $18,245

- Terminal Value (TV): $99,929

- PV of Terminal Value: $69,606

- Enterprise Value (EV): $87,851

- Net Debt: -9,661

- Equity Value: $97,512

- Shares Outstanding: 109M

- Intrinsic Value per Share: $890.68

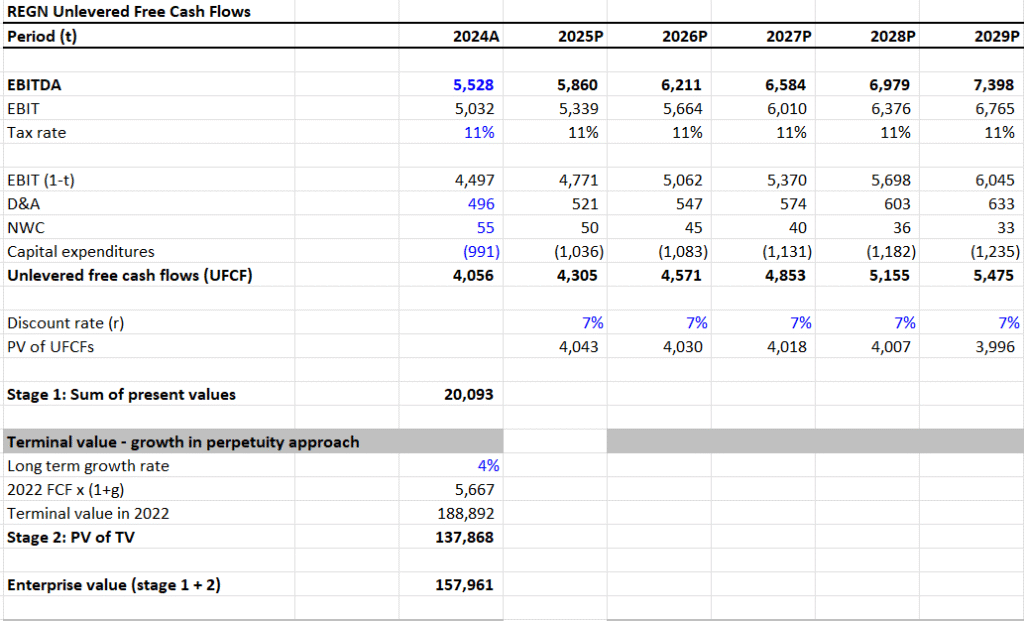

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- PV of UFCF (2024–2029): $20,093

- Terminal Value (TV): $188,892

- PV of Terminal Value: $137,868

- Enterprise Value (EV): $157,961

- Net Debt: -9,661

- Equity Value: $167,622

- Shares Outstanding: 109M

- Intrinsic Value per Share: $1,531.08

IV. Valuation Summary and Upside Potential

- Current Price: $545

- Bear Case: $584.54 → 7.3% upside

- Base Case: $890.68 → 63.5% upside

- Bull Case: $1,531.08 → 181% upside

V. Dividend Sustainability

- Dividend per Share: $0.88

- Shares Outstanding: 109M

- Total Dividends Paid: $96M

- Free Cash Flow (Used): $2,962M

- Dividend Payout Ratio (FCF basis): $96M / $2,962M = ~3.2%

- Assessment: Very low payout ratio, suggesting extremely high dividend sustainability and significant retained earnings for reinvestment or buybacks.

VI. Summary Conclusion

Based on robust DCF modeling across scenarios:

- Dividend Health: Excellent payout sustainability with minimal risk.

- Valuation Outlook: REGN appears undervalued even under conservative estimates with notable long-term upside potential.

Valuation Range: $584 – $1,531

Check Out – Elevance Health (ELV) Stock Analysis with the Best Investing Strategy for Long Term Gains (2025)