VICI Properties (NYSE: VICI) stands out as an alpha stock combining stable cash flow with long term upside potential. With projected valuations offering up to 235% upside and a dividend payout ratio of 85%, VICI is one of the best stock to invest in for beginners seeking public stock opportunities. A must-watch in your stock search if you’re looking for strong buy stocks today.

All figures are in millions of USD unless otherwise stated.

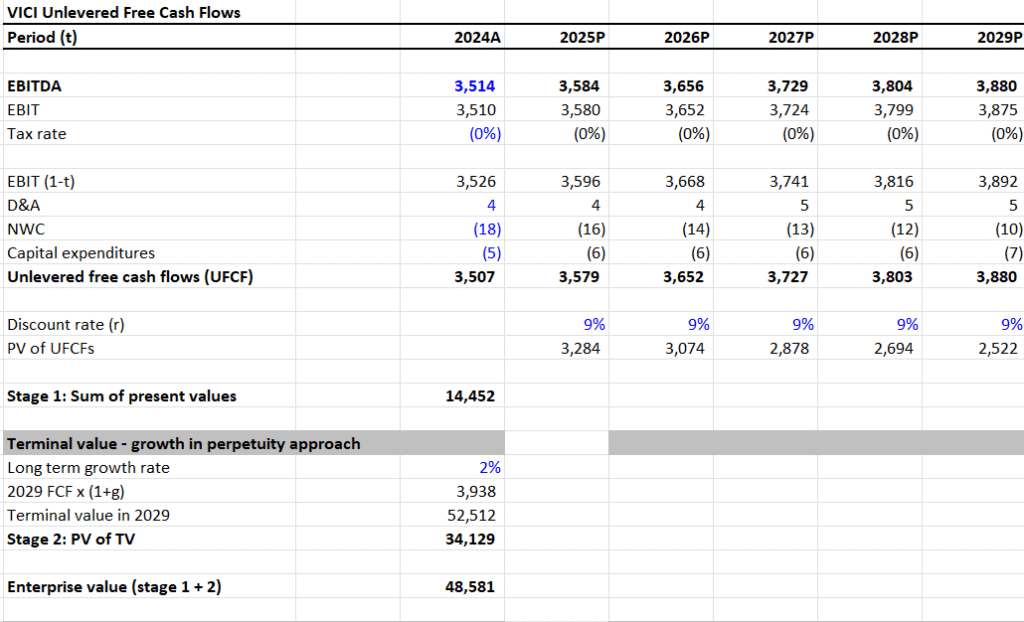

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $14,452

- Terminal Value (TV): $52,512

- PV of Terminal Value: $34,129

- Enterprise Value (EV): $48,581

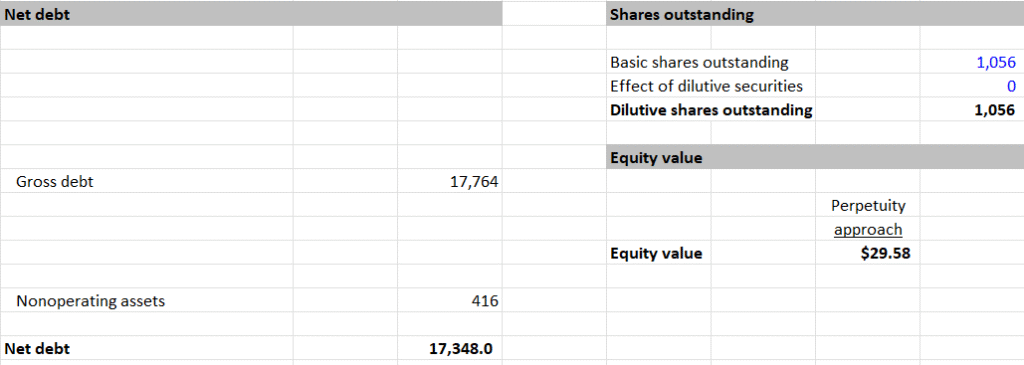

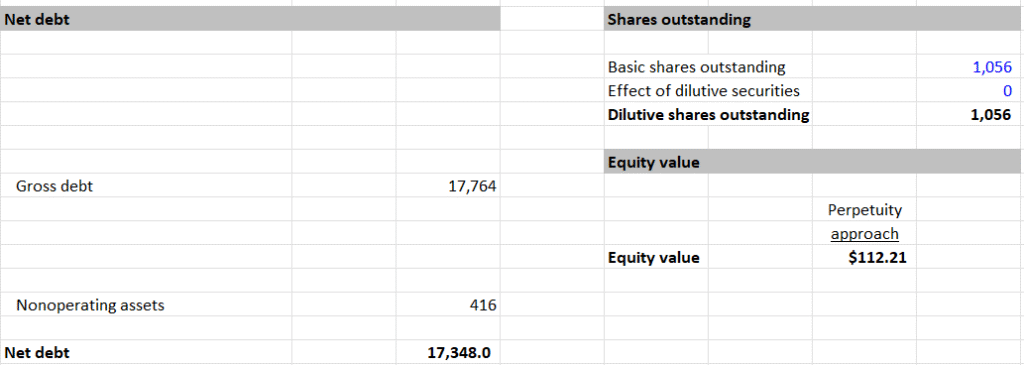

- Net Debt: $17,348

- Equity Value: $31,233

- Shares Outstanding: 1,056M

- Intrinsic Value per Share: $29.58

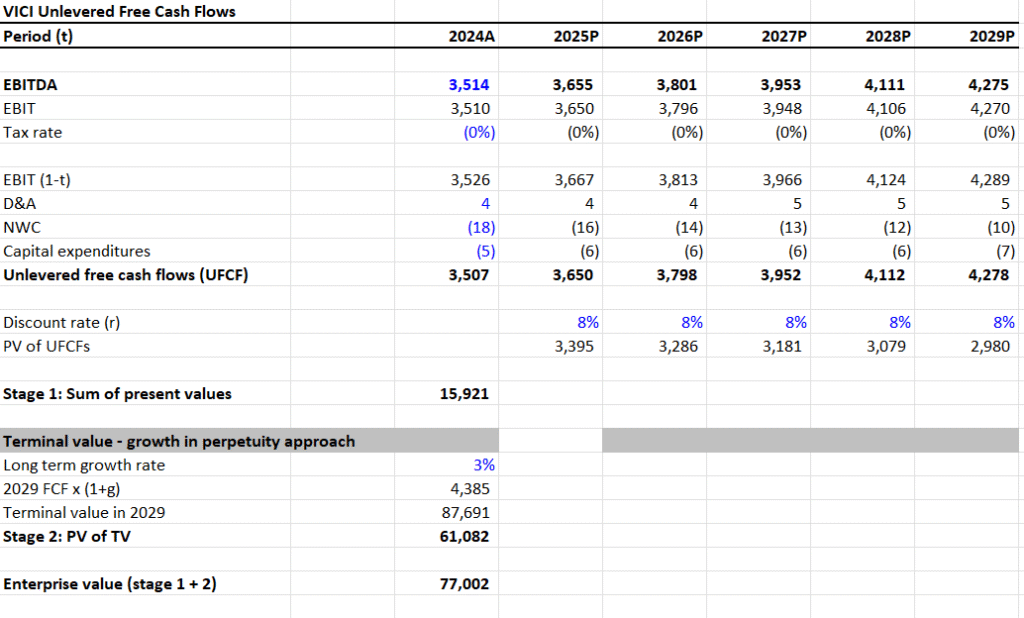

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $15,921

- Terminal Value (TV): $87,691

- PV of Terminal Value: $61,082

- Enterprise Value (EV): $77,002

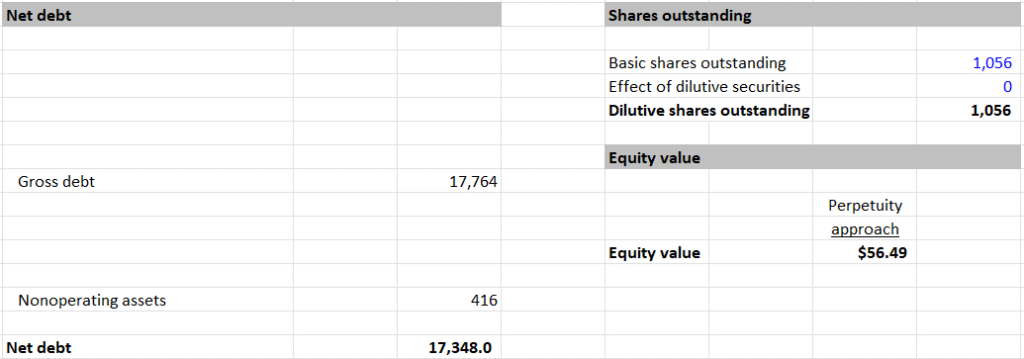

- Net Debt: $17,348

- Equity Value: $59,654

- Shares Outstanding: 1,056M

- Intrinsic Value per Share: $56.49

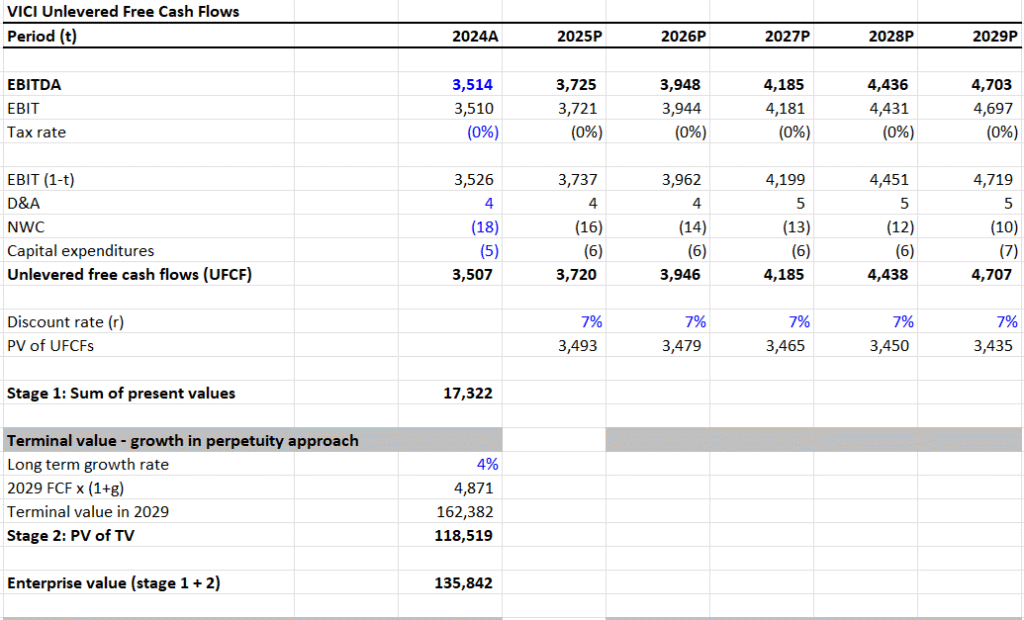

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $17,322

- Terminal Value (TV): $162,382

- PV of Terminal Value: $118,519

- Enterprise Value (EV): $135,842

- Net Debt: $17,348

- Equity Value: $118,494

- Shares Outstanding: 1,056M

- Intrinsic Value per Share: $112.21

IV. Valuation Summary and Upside Potential

- Current Price: $33.43

- Bear Case Intrinsic Value: $29.58 → -11.5% downside

- Base Case Intrinsic Value: $56.49 → 69% upside

- Bull Case Intrinsic Value: $112.21 → 236% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $1.71

- Shares Outstanding: 1,056M

- Total Dividends Paid: 1,056 × 1.71 = $1,806M

- Free Cash Flow (Used for Analysis): $2,424M

- Dividend Payout Ratio (FCF Basis):

- $1,806 / $2,424 = 0.745 or ~74.5%

- Assessment:

- Payout ratio is moderately high

- Company retains around 25% of FCF after dividends

- Conclusion: Dividend appears generally sustainable, but any pressure on FCF could challenge future raises

VI. Summary View

This report is based purely on data-driven modeling and presents a range of fair values based on different economic conditions and growth outlooks.

- DCF Highlights: Base and bull scenarios show strong upside relative to market price

- Dividend View: Payout is high but manageable

- Quantitative Takeaway: VICI appears undervalued in the long run under modest or strong growth assumptions

Valuation Range: $29.58 – $112.21

Why Travelers (TRV) Could Be One of the Best Long Term Stock Investments Today