Is EOG Resources (NYSE: EOG) one of the best value stocks in today’s market? This blog dives into a structured Discounted Cash Flow (DCF) valuation across Bear, Base, and Bull scenarios, ideal for anyone playing stocks with a focus on value investing. Built on unlevered free cash flow projections and realistic growth assumptions, the analysis reveals why EOG could be a top contender among the hottest stocks. Plus, we assess the company’s strong dividend coverage, making it a solid pick for value-focused investors.

All figures are in millions of USD unless otherwise stated.

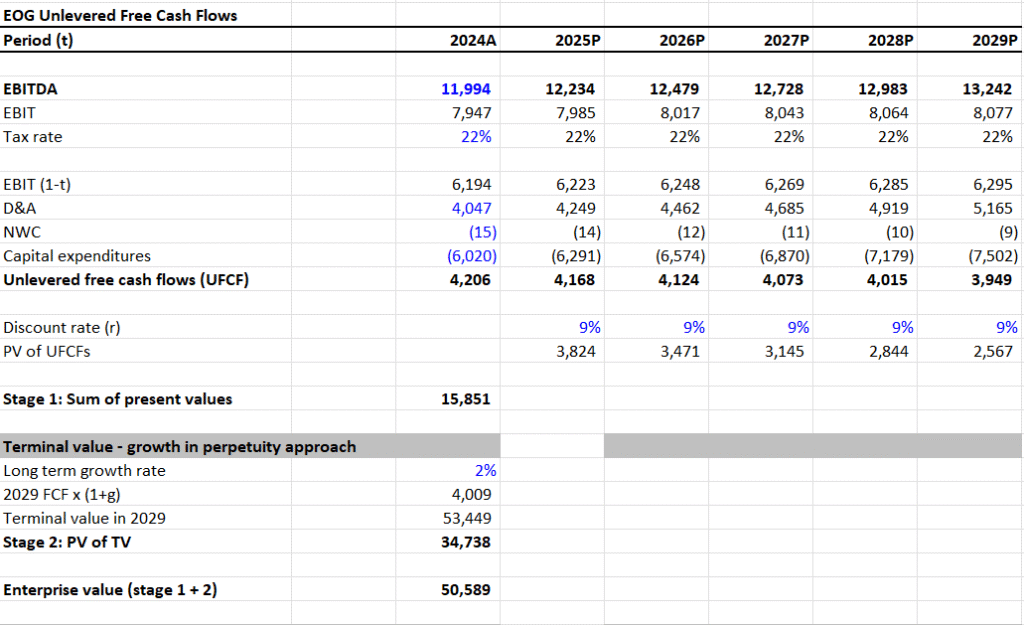

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $15,851

- Terminal Value (TV): $53,449

- PV of Terminal Value: $34,738

- Enterprise Value (EV): $50,589

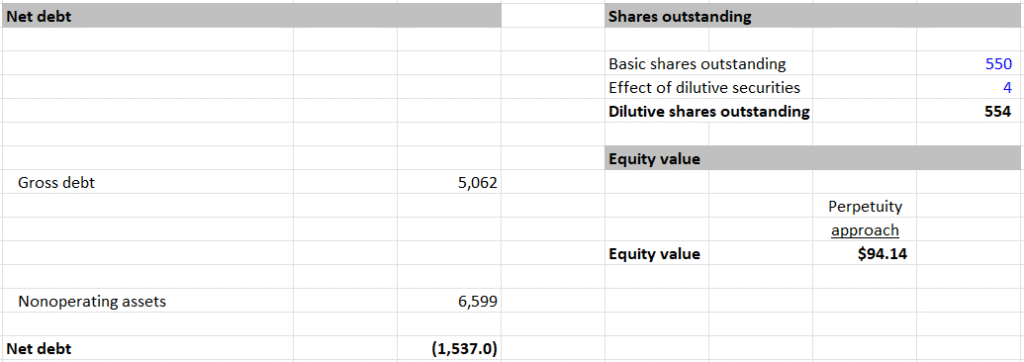

- Net Debt: -$1,537

- Equity Value: $52,126

- Shares Outstanding: 554M

- Intrinsic Value per Share: $94.14

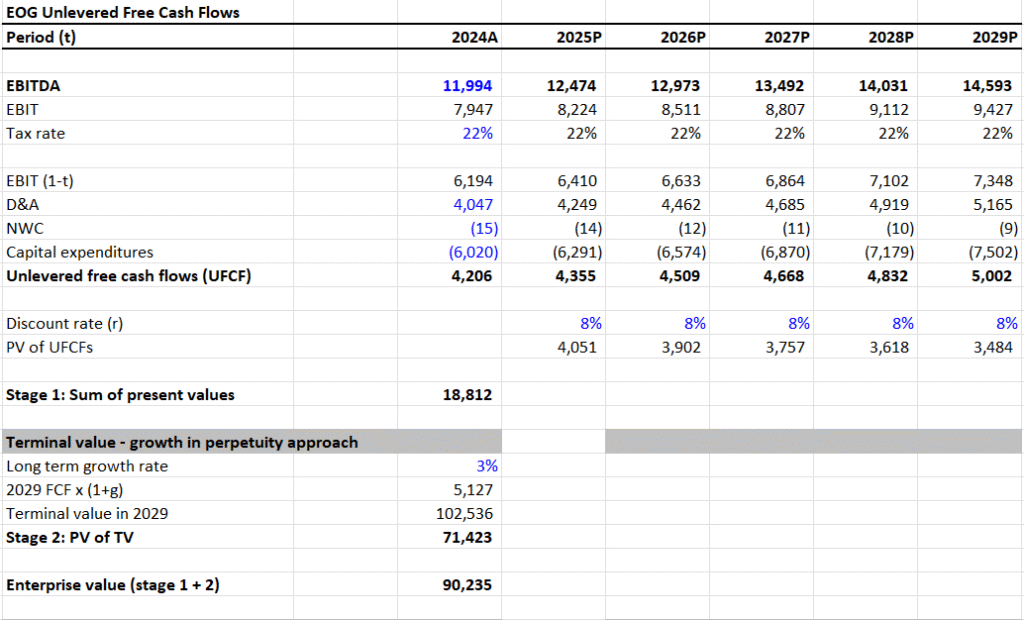

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $18,812

- Terminal Value (TV): $102,536

- PV of Terminal Value: $71,423

- Enterprise Value (EV): $90,235

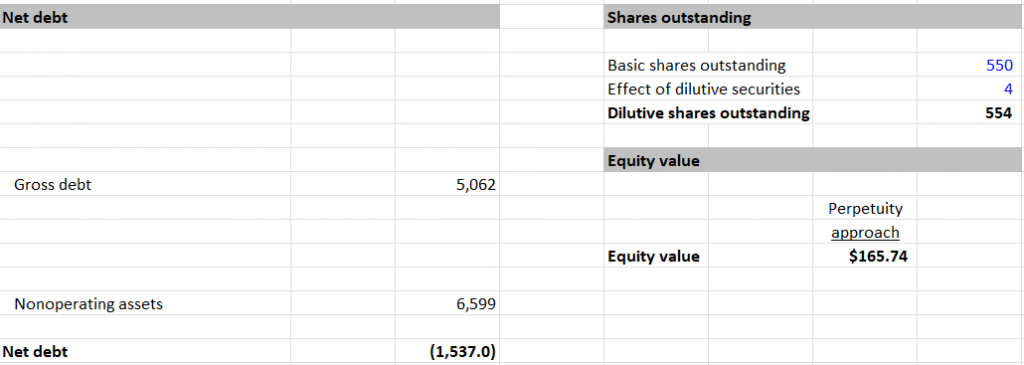

- Net Debt: -$1,537

- Equity Value: $91,772

- Shares Outstanding: 554M

- Intrinsic Value per Share: $165.74

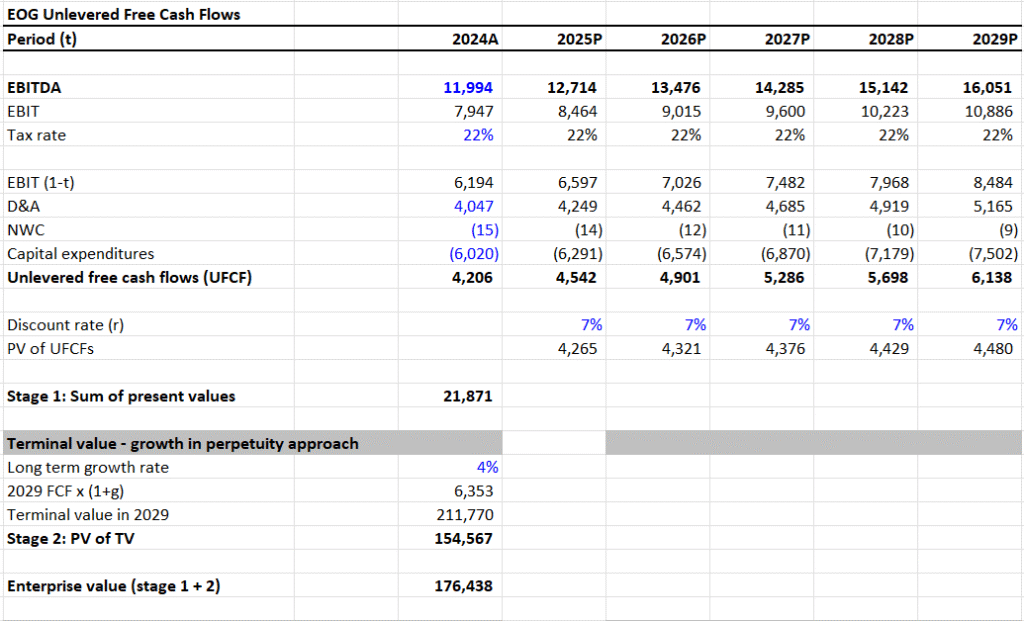

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $21,871

- Terminal Value (TV): $211,770

- PV of Terminal Value: $154,567

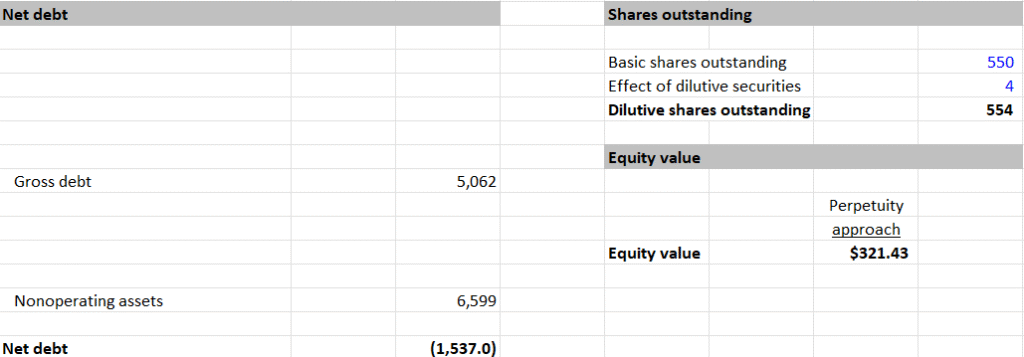

- Enterprise Value (EV): $176,438

- Net Debt: -$1,537

- Equity Value: $177,975

- Shares Outstanding: 554M

- Intrinsic Value per Share: $321.43

IV. Valuation Summary and Upside Potential

- Current Price: $125

- Bear Case Intrinsic Value: $94.14 → -25% downside

- Base Case Intrinsic Value: $165.74 → 32% upside

- Bull Case Intrinsic Value: $321.43 → 157% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $3.71

- Shares Outstanding: 554M

- Total Dividends Paid: 554 × 3.71 = $2,056M

- Free Cash Flow (Used for Analysis): $5,509M

- Dividend Payout Ratio (FCF Basis):

- $2,056 / $5,509 = 0.373 or ~37.3%

- Assessment:

- Payout ratio is well within sustainable levels

- Over 60% of FCF retained, supporting reinvestment or future increases

- Conclusion: Dividend appears sustainable, with room for continued payout under current free cash flow performance

VI. Summary View

This data-driven, scenario-based analysis demonstrates that EOG trades at a substantial discount to its modeled fair value in the base and bull scenarios. The bear case suggests slight overvaluation, implying limited downside risk.

- DCF Takeaway: The intrinsic value per share spans from $94.14 (Bear) to $321.43 (Bull)

- Dividend Insight: The 37% payout ratio reinforces dividend safety and cash flow efficiency

- Quantitative Summary: At $125, EOG is potentially undervalued, especially if base or optimistic scenarios materialize

Valuation Range: $94.14 – $321.43

The Hartford (HIG): DCF Valuation Reveals Undervalued Intrinsic Value Across Scenarios (2025)