Amid short-term market volatility, UnitedHealth Group (NYSE: UNH), currently trading at $298, stands out as one of the good value stocks worth watching. This report delivers a data-driven Discounted Cash Flow (DCF) valuation under Bear, Base, and Bull scenarios, helping investors identify if UNH is truly one of the underpriced stocks in today’s good stock market. With a clear dividend sustainability analysis based on free cash flow, this post offers valuable insights for your investing strategy and belongs on every investor’s news radar and best stock watchlist.

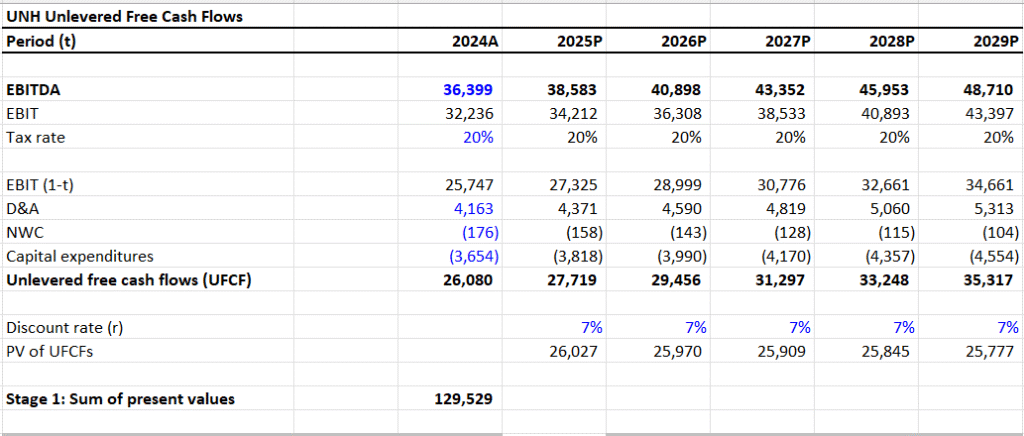

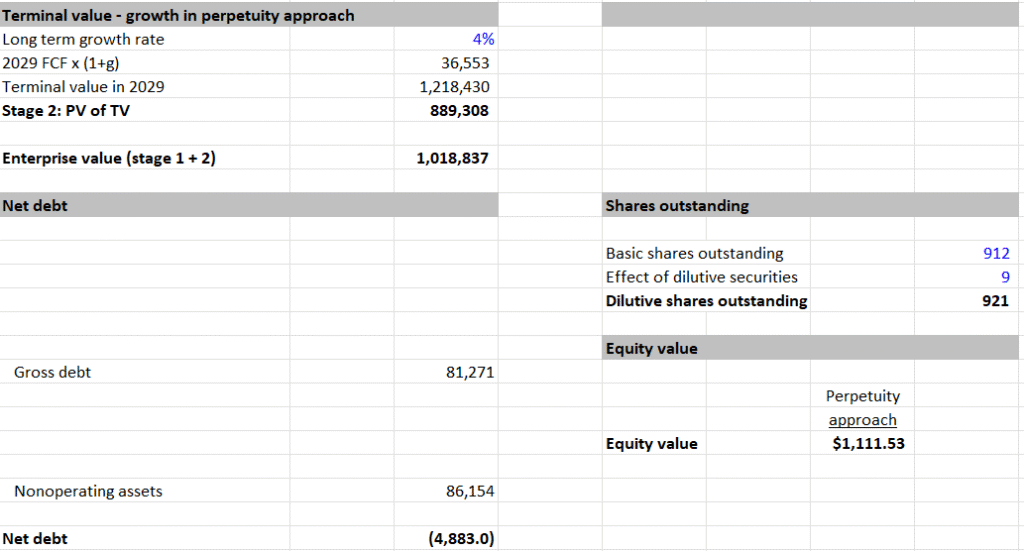

All figures are in millions of USD unless otherwise stated.

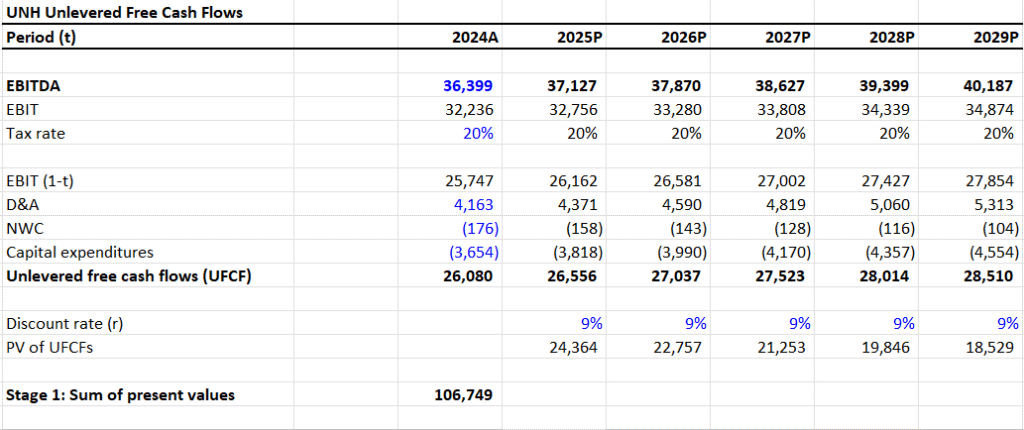

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF (2024–2029): $106,749

- Terminal Value (TV): $385,831

- PV of Terminal Value: $250,764

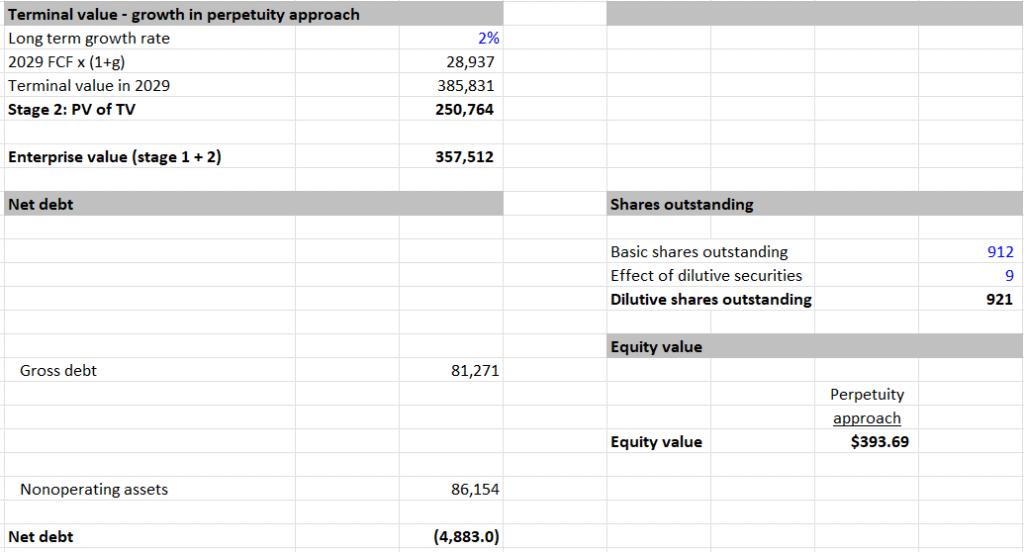

- Enterprise Value (EV): $357,512

- Net Debt: $4,883

- Equity Value: $352,629

- Shares Outstanding: 912M

- Intrinsic Value per Share: $393.69

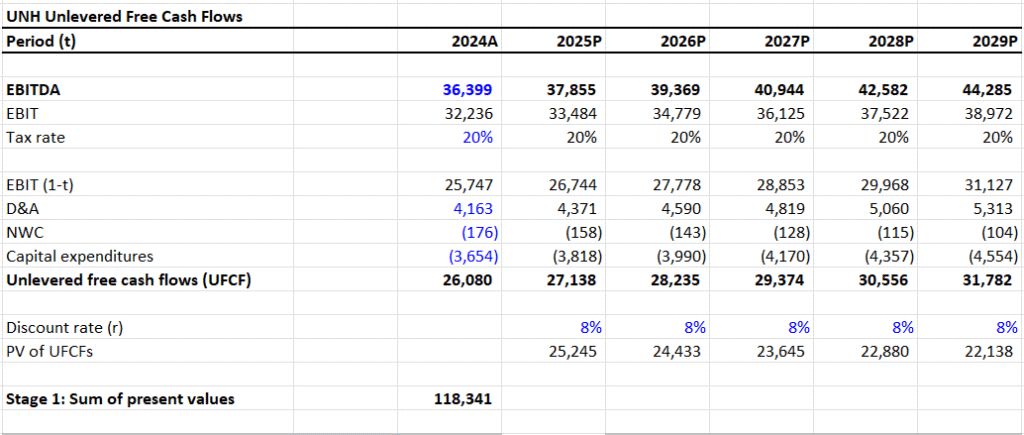

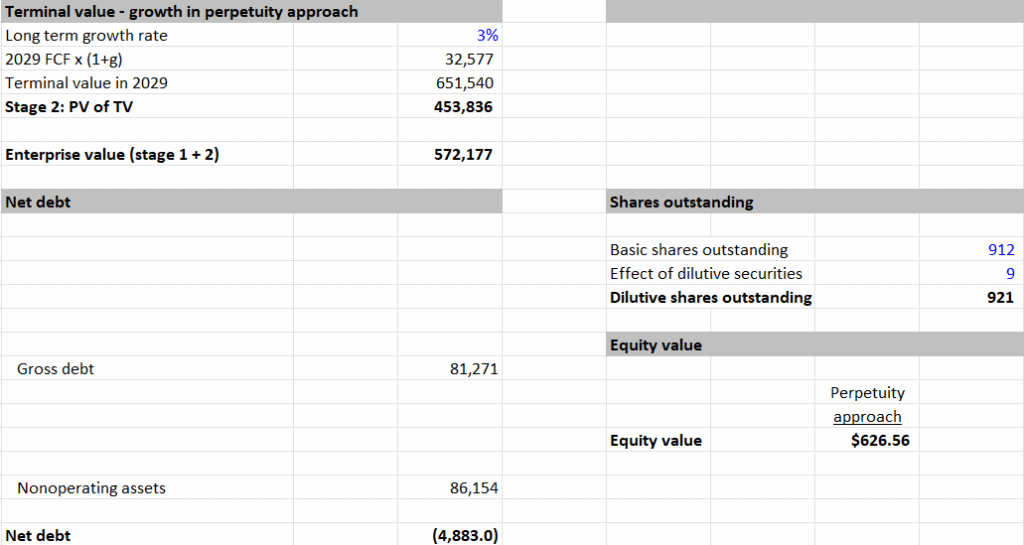

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF (2024–2029): $118,341

- Terminal Value (TV): $651,540

- PV of Terminal Value: $453,836

- Enterprise Value (EV): $572,177

- Net Debt: $4,883

- Equity Value: $567,294

- Shares Outstanding: 912M

- Intrinsic Value per Share: $626.56

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF (2024–2029): $129,529

- Terminal Value (TV): $1,218,430

- PV of Terminal Value: $889,308

- Enterprise Value (EV): $1,018,837

- Net Debt: $4,883

- Equity Value: $1,013,954

- Shares Outstanding: 912M

- Intrinsic Value per Share: $1,111.53

IV. Valuation Summary and Upside Potential

- Current Price: $298

- Bear Case Intrinsic Value: $393.69 → 32% upside

- Base Case Intrinsic Value: $626.56 → 110% upside

- Bull Case Intrinsic Value: $1,111.53 → 273% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $8.40

- Shares Outstanding: 912M

- Total Dividends Paid: 912 × 8.40 = $7,661M

- Free Cash Flow (Used for Analysis): $24,862M

- Dividend Payout Ratio (FCF Basis):

- $7,661 / $24,862 = 0.308 or ~30.8%

- Assessment:

- Payout ratio is comfortably below common risk thresholds (50–60%)

- Company retains nearly 70% of FCF after paying dividends

- Conclusion: Dividend appears highly sustainable, with considerable flexibility to maintain or raise the payout.

VI. Summary View

This report avoids narrative and remains grounded in a quantitative, scenario-driven framework. Each case reflects a different assumption set for growth, risk, and capital structure, offering a robust view of valuation bands.

- DCF Highlights: UNH trades well below its modeled fair value under all three cases

- Dividend View: Strong and secure, with a 31% payout ratio

- Quantitative Takeaway: At $298, UNH’s price does not reflect the intrinsic value supported by forecasted cash flows and capital discipline

Valuation Range: $393.69 – $1,111.53