Looking for the best growth stocks for the next 5 years or the best value stocks right now? This in-depth report on Merck & Co. (NYSE: MRK), currently trading at $77.30, offers a comprehensive intrinsic valuation using a Discounted Cash Flow (DCF) model across Bear, Base, and Bull scenarios. It’s a valuable stock search tool for investors exploring reliable public stocks. The analysis also includes a dividend sustainability review based on free cash flow, making this a must-read for anyone investing in shares and stocks with long-term potential.

All monetary values are expressed in millions of USD unless otherwise specified.

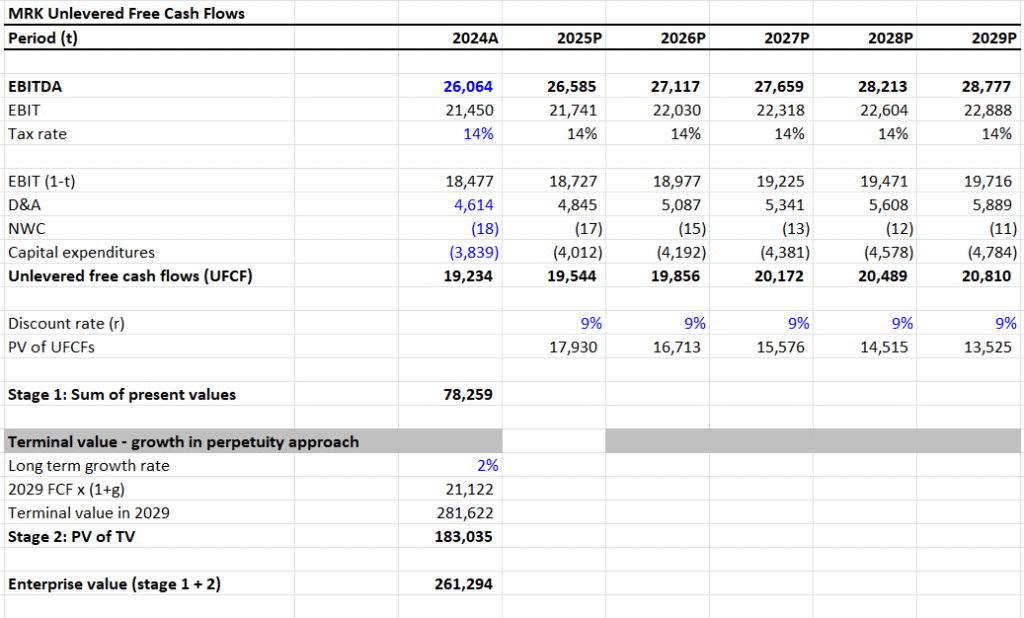

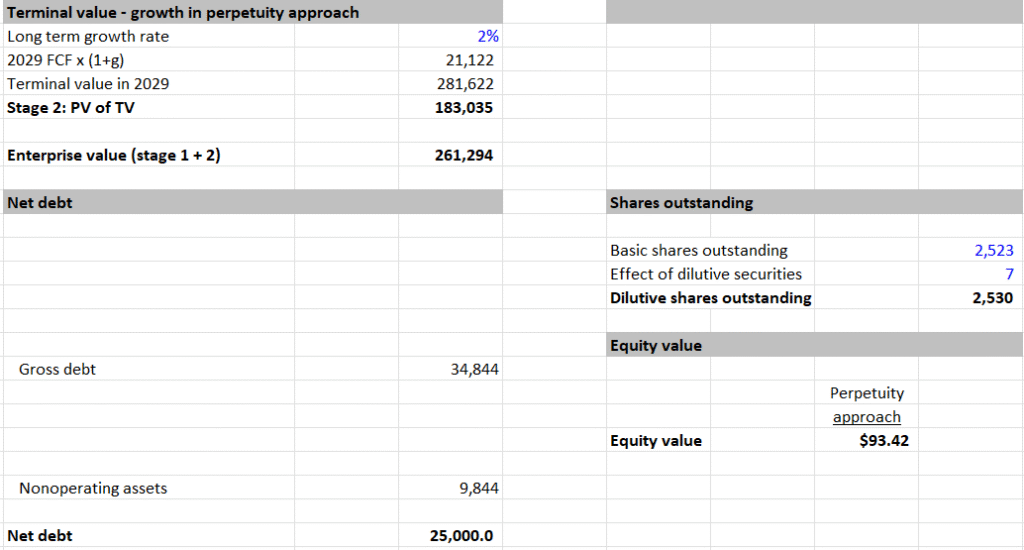

I. DCF Valuation — Bear Case

- EBITDA Growth Rate: 2%

- Terminal Growth Rate: 1.5%

- Discount Rate: 9%

- Sum of PV of UFCF: $78,259

- Terminal Value (TV): $281,622

- PV of Terminal Value: $183,035

- Enterprise Value (EV): $261,294

- Net Debt: $25,000

- Equity Value: $236,294

- Shares Outstanding: 2,523M

- Intrinsic Value per Share: $93.42

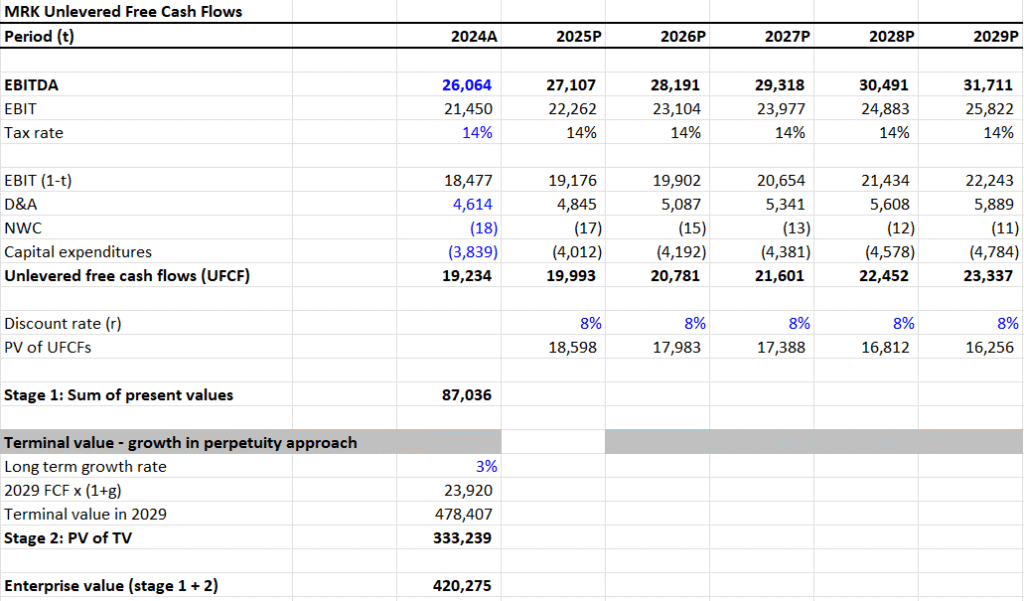

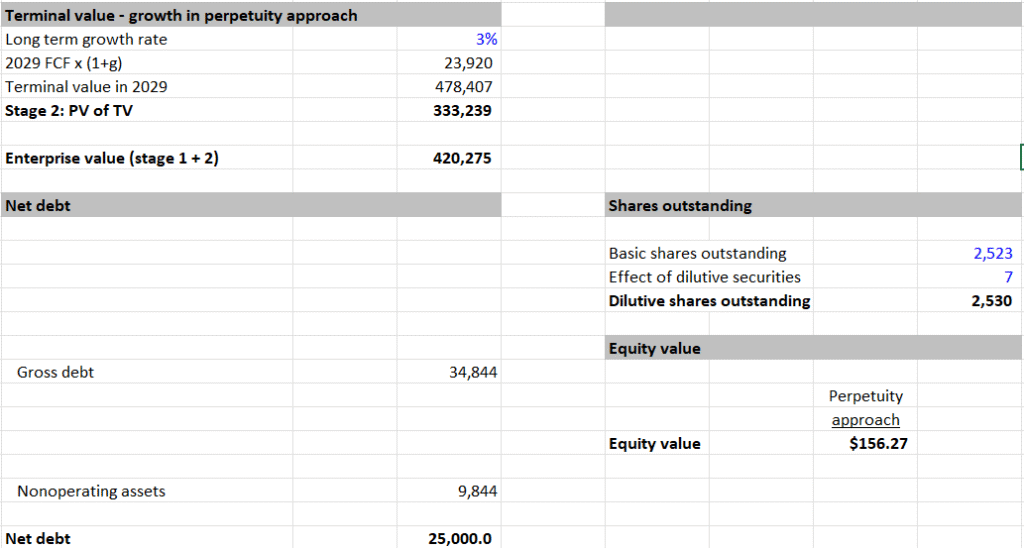

II. DCF Valuation — Base Case

- EBITDA Growth Rate: 4%

- Terminal Growth Rate: 2.5%

- Discount Rate: 7.5%

- Sum of PV of UFCF: $87,036

- Terminal Value (TV): $478,407

- PV of Terminal Value: $333,239

- Enterprise Value (EV): $420,275

- Net Debt: $25,000

- Equity Value: $395,275

- Shares Outstanding: 2,523M

- Intrinsic Value per Share: $156.27

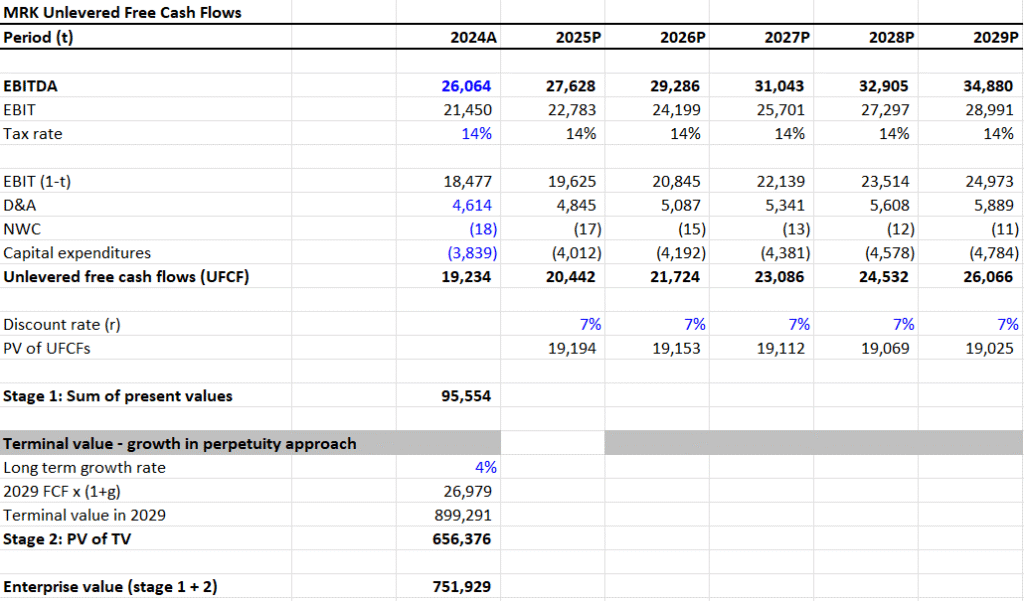

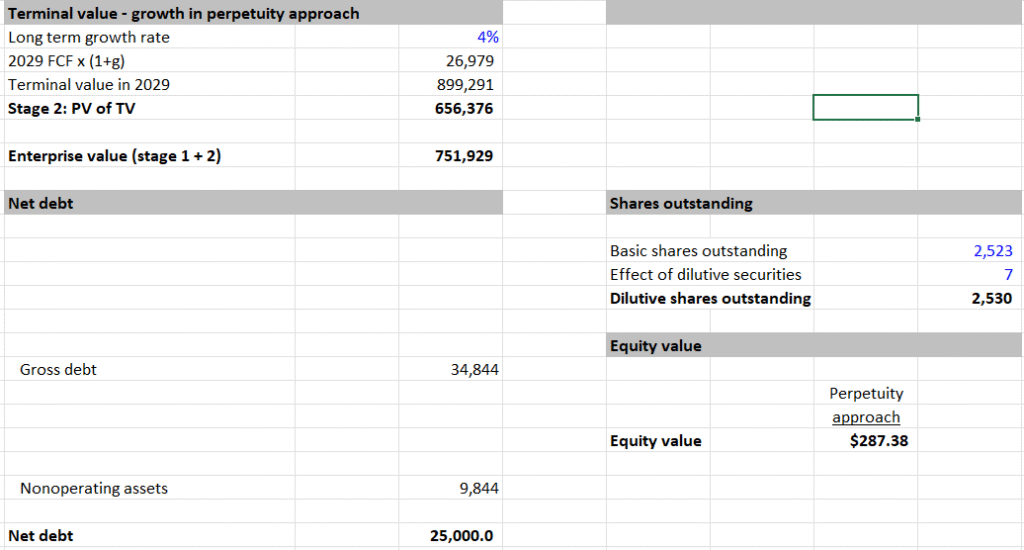

III. DCF Valuation — Bull Case

- EBITDA Growth Rate: 6%

- Terminal Growth Rate: 3.5%

- Discount Rate: 6.5%

- Sum of PV of UFCF: $95,554

- Terminal Value (TV): $899,291

- PV of Terminal Value: $656,376

- Enterprise Value (EV): $751,929

- Net Debt: $25,000

- Equity Value: $726,929

- Shares Outstanding: 2,523M

- Intrinsic Value per Share: $287.38

IV. Valuation Summary and Upside Potential

- Current Share Price: $77.30

- Bear Case Intrinsic Value: $93.42 → 21% upside

- Base Case Intrinsic Value: $156.27 → 102% upside

- Bull Case Intrinsic Value: $287.38 → 271% upside

V. Dividend Sustainability Analysis

- Dividend per Share: $3.16

- Shares Outstanding: 2,523M

- Total Dividends Paid: 2,523 × 3.16 = $7,976.68M

- Free Cash Flow (FCF): $17,039M

- Dividend Payout Ratio (FCF Basis):

- 7,976.68 / 17,039 = 0.468 or 46.8%

Assessment:

- With a sub-50% payout ratio, MRK retains significant free cash flow for reinvestment or debt reduction.

- Dividend appears sustainable based on current cash flow and payout trends.

VI. Quantitative Takeaway

MRK appears undervalued across all DCF scenarios, with the current market price far below modeled intrinsic value estimates.

- The company demonstrates strong, consistent UFCF across projections

- The dividend is well-covered by FCF, offering reliability for income-focused investors

- This quantitative, scenario-driven model highlights meaningful upside potential with limited downside risk

Valuation Range: $93.42 – $287.38

The Hartford (HIG): DCF Valuation Reveals Undervalued Intrinsic Value Across Scenarios (2025)