Looking for the best stocks to invest in? This in-depth stock analysis of PayPal Holdings (NASDAQ: PYPL) uses a Discounted Cash Flow (DCF) model to forecast potential returns under Bear, Base, and Bull case scenarios. Whether you’re investing in stocks for long-term growth or building a portfolio of top growth stocks, this report highlights why PYPL could be one of the most promising stocks to invest in right now. Also included is a look at PayPal’s free cash flow and dividend sustainability, essential insights for smart investors.

All figures are in millions of USD unless otherwise stated.

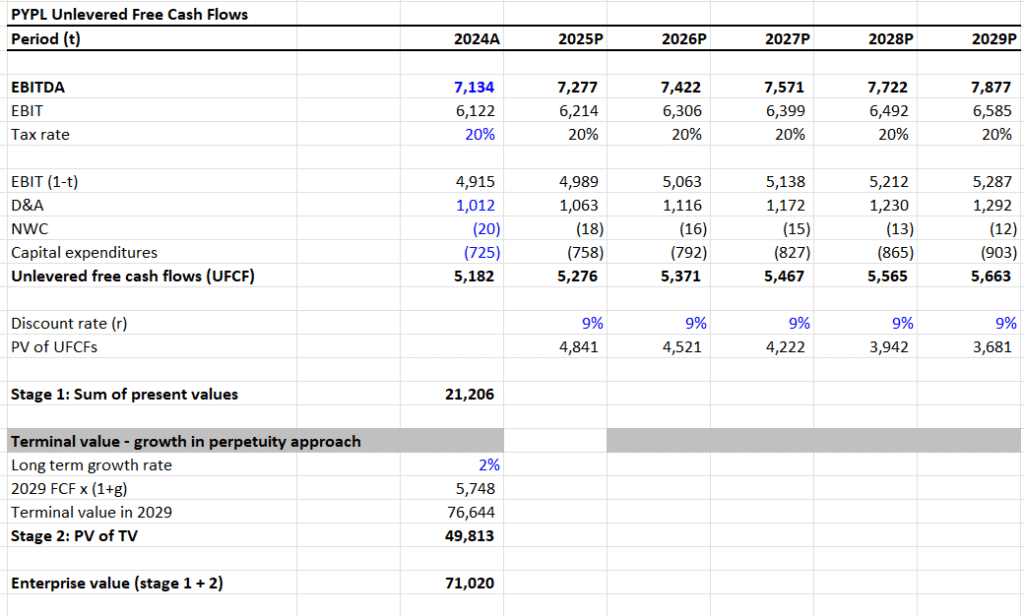

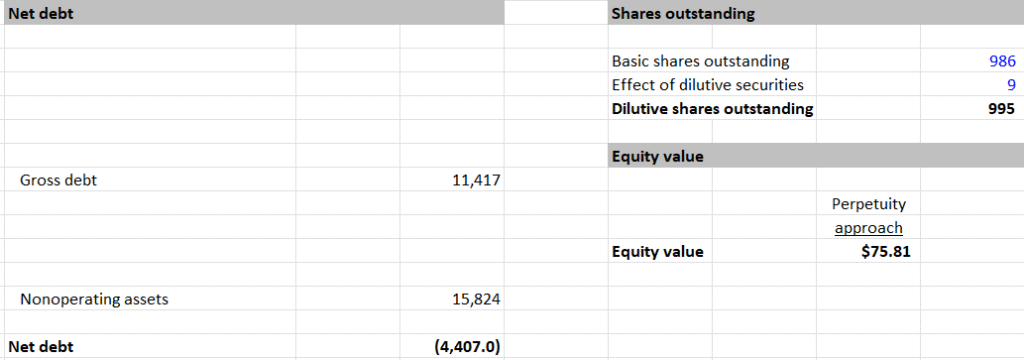

I. DCF Valuation — Bear Case

EBITDA Growth Rate: 2%

Terminal Growth Rate: 1.5%

Discount Rate: 9%

Sum of PV of UFCF (2024–2029): $21,206

Terminal Value (TV): $76,644

PV of Terminal Value: $49,813

Enterprise Value (EV): $71,020

Net Debt: -$4,407

Equity Value: $75,427

Shares Outstanding: 995M

Intrinsic Value per Share: $75.81

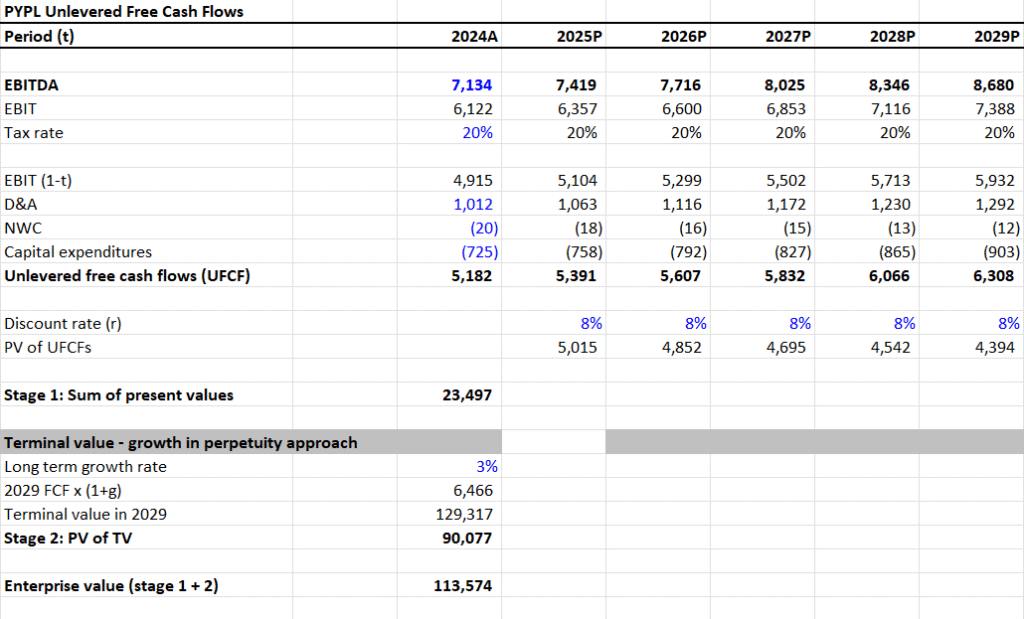

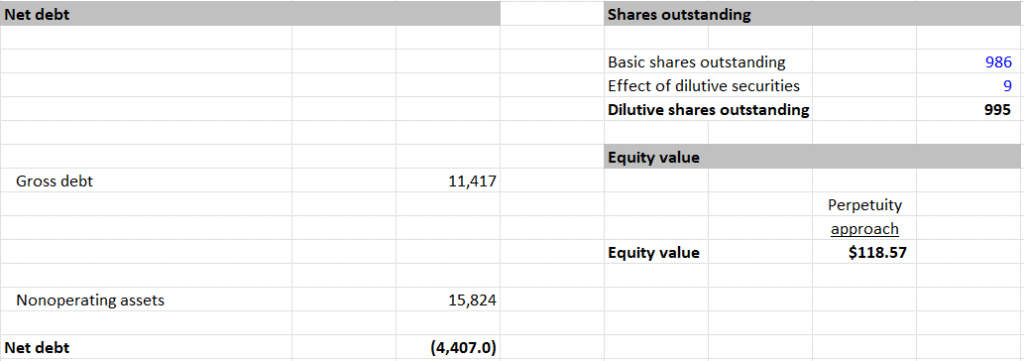

II. DCF Valuation — Base Case

EBITDA Growth Rate: 4%

Terminal Growth Rate: 2.5%

Discount Rate: 7.5%

Sum of PV of UFCF (2024–2029): $23,497

Terminal Value (TV): $129,317

PV of Terminal Value: $90,077

Enterprise Value (EV): $113,574

Net Debt: -$4,407

Equity Value: $117,981

Shares Outstanding: 995M

Intrinsic Value per Share: $118.57

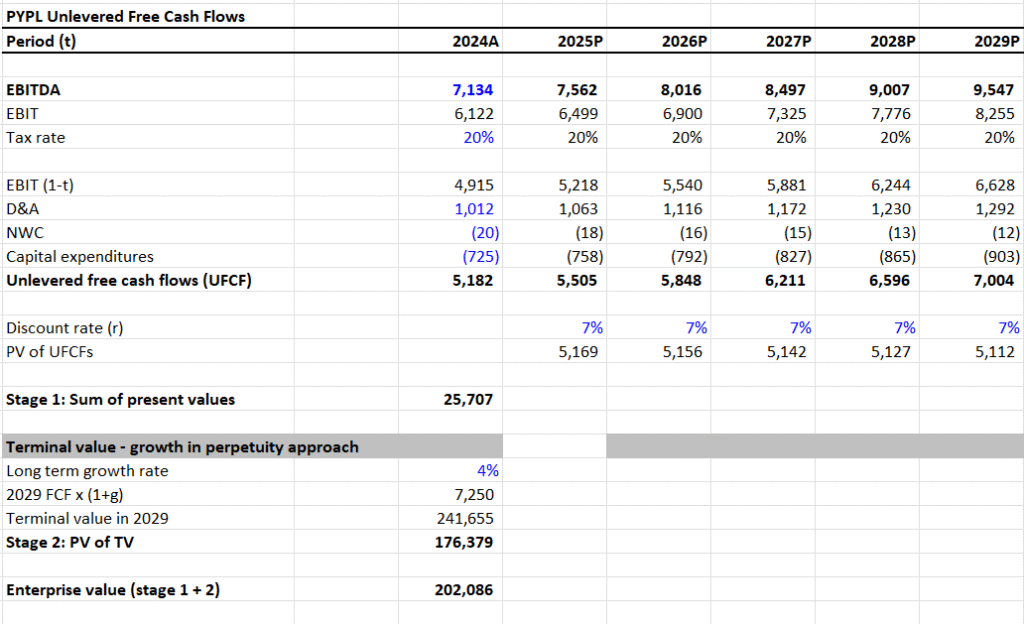

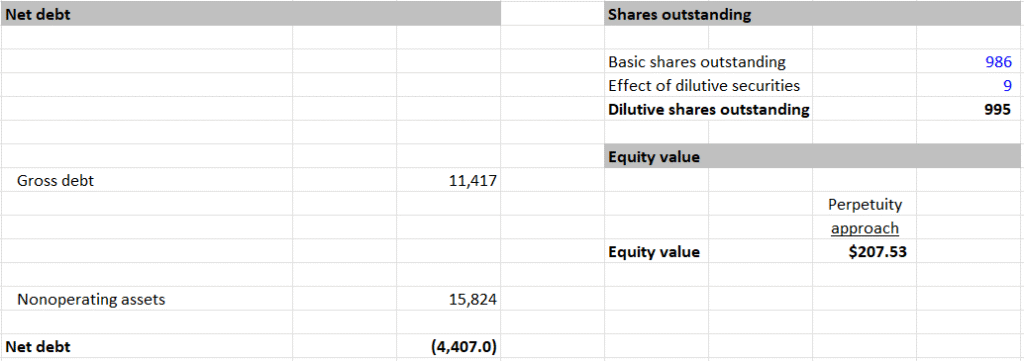

III. DCF Valuation — Bull Case

EBITDA Growth Rate: 6%

Terminal Growth Rate: 3.5%

Discount Rate: 6.5%

Sum of PV of UFCF (2024–2029): $25,707

Terminal Value (TV): $241,655

PV of Terminal Value: $176,379

Enterprise Value (EV): $202,086

Net Debt: -$4,407

Equity Value: $206,493

Shares Outstanding: 995M

Intrinsic Value per Share: $207.53

IV. Valuation Summary and Upside Potential

Current Price: $70.05

Bear Case Intrinsic Value: $75.81 → 8% upside

Base Case Intrinsic Value: $118.57 → 69% upside

Bull Case Intrinsic Value: $207.53 → 196% upside

V. Dividend Sustainability Analysis

Dividend per Share: $0.00

Shares Outstanding: 995M

Total Dividends Paid: $0

Free Cash Flow (Used for Analysis): $5,968M

Dividend Payout Ratio (FCF Basis):

$0 / $5,968 = 0.00 or 0%

Assessment:

No dividends are being paid at present

All cash flow is retained for reinvestment or other uses

Conclusion: Dividend payments are not in practice. However, the company has ample room for initiating shareholder returns via dividends if management chooses to in the future.

VI. Summary View

This valuation is purely quantitative and based on forecasted UFCF ranges under varying macroeconomic and operational assumptions. The model shows that PayPal is undervalued under all three cases, with the strongest valuation support in the base and bull scenarios.

DCF Highlights: PYPL is trading well below its intrinsic value in all scenarios.

Dividend View: No dividends currently paid; company retains 100% of free cash flow.

Quantitative Takeaway: At $70.05, the market significantly discounts PayPal’s cash flow potential, especially under moderate to optimistic growth scenarios.

Valuation Range: $75.81 – $207.53